Bloomberg reports that the sale of the founder of Huobi Group’s controlling interest in the cryptocurrency exchange may be the biggest takeover in the sector since the start of a $2 trillion global crypto crisis.

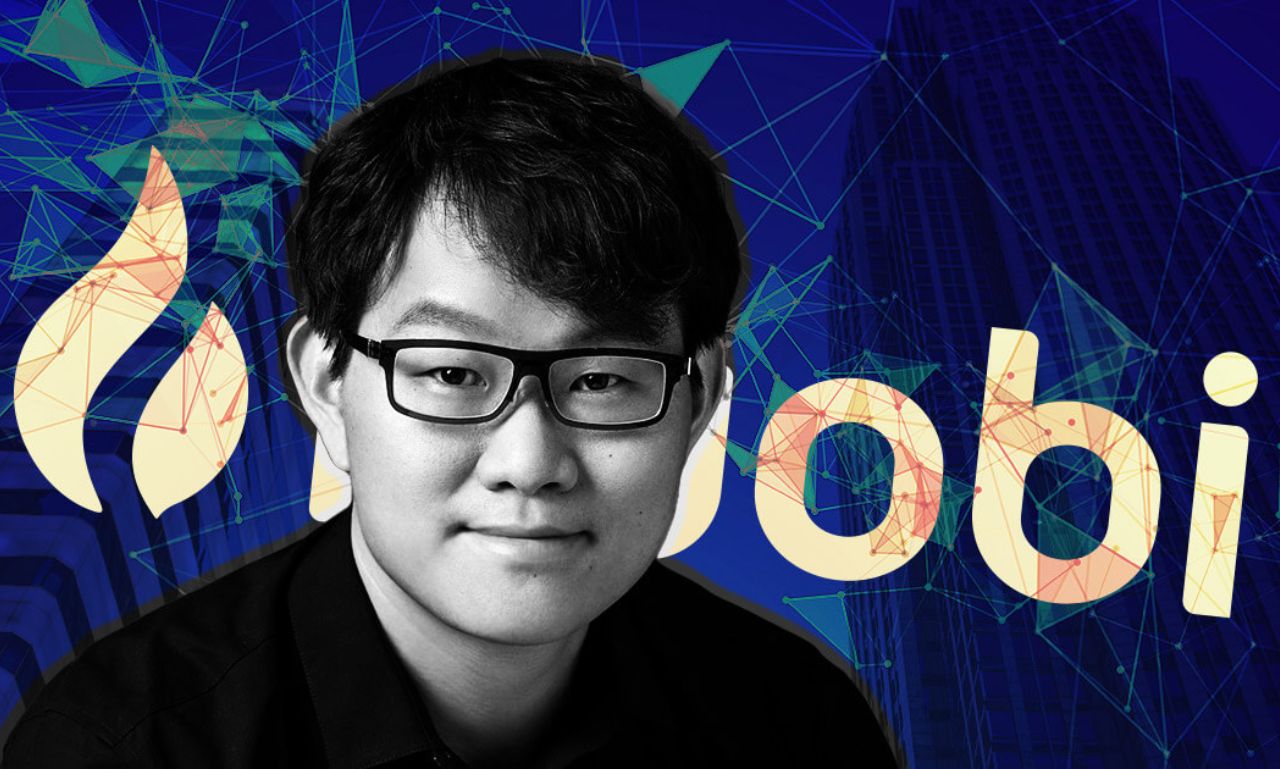

Leon li is negotiating with several investors to sell a stake valued at approximately $3 billion, or 60% of the business he founded almost ten years ago.

People with knowledge of the situation have distributed the report. They said the Chinese crypto-mogul has already gotten in touch with FTX, run by crypto-billionaire Sam Bankman-Fried and Tron founder Justin Sin, regarding a share transfer.

According to the source, Li is requesting a valuation of $2 to $3 billion, which suggests that the scale may sell for more than $1 billion.

Additionally, they said that the purchase might be completed by the end of this month after existing backers ZhenFund and Sequoia China were told of Li’s decision during a July shareholders’ meeting.

A Huobi representative told Bloomberg in an email that “he thinks that the new shareholders will be more strong and resourceful and that they will cherish the Huobi brand and invest more money and energy to drive the expansion of Huobi,” without going into further detail.

Huobi, which was co-founded in 2013 by Li, a former programmer for Oracle Corp., was once the busiest bitcoin trading platform worldwide, notably in China. However, as China prohibited cryptocurrency transactions last year, it had to start expanding into foreign markets. Since then, it has faced tougher competition from companies like FTX and Binance.

Early in August, Huobi applied the Australian Transaction Reports and Analysis Centre to be registered as a supplier of digital currency exchange services (AUSTRAC).

While the cryptocurrency exchange platform joined other crypto exchanges to increase its presence in the gulf country after receiving a provisional license from the Dubai Virtual Assets Regulatory Authority (VARA) in late July.

Huobi processed slightly more than 50% of the transactions handled by Coinbase Global Inc. over the 24 hours of August 12, according to the data tracker CoinGecko, handling around $1.12 billion in cryptocurrency transactions.