The robust expansion of the Solana ecosystem in the second quarter of 2022 is attributed, in part, to the success of GameFi and DAOs, as stated in a study that spans 32 pages and was compiled and published by ByBit.

During the course of the quarter, there was a rise in DAO activity, ongoing volatility in NFT markets, robust interaction with GameFi, and a decrease in DeFi’s market share.

Troubles of Solana

Even while certain areas of the network may have had a healthy expansion, the whole thing was plagued with difficulties. During this time period, there were two major disruptions to the network. On the other hand, it seems that the improvements made to Solana are having the desired effect, as noted in the report:

“Network upgrades that were implemented around the end of the second quarter demonstrated considerable improvements in transaction processing and dependability.”

In addition, the paper highlighted the problems that have been occurring with Solend, Slope Finance, Crema, Nirvana, and Saga as illustrations of cases of network security that need to be significantly improved. Even though some of these events took place at the beginning of Q3, we decided to include them because of their possible influence on future Solana growth.

As the market as a whole has been selling off, the price has followed suit, falling from a high of $146 during the first quarter to a low of $26 during the second quarter. However, $SOL has also lost 46% of its value compared to Bitcoin, suggesting that the Solana collapse was relatively independent of the overall market.

Positives in Favor of Solana

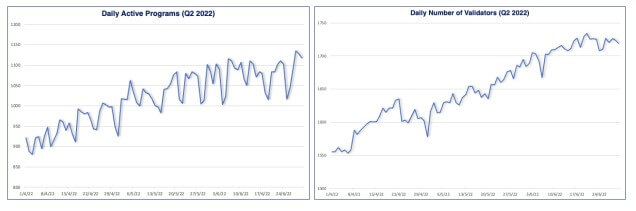

Nevertheless, in terms of on-chain activity, the study is supported by bullish figures, which lend credence to the idea that Solana sees network expansion despite the downward pricing pressure. As can be seen in the graph below, both the number of validators and the number of daily active programs are steadily rising.

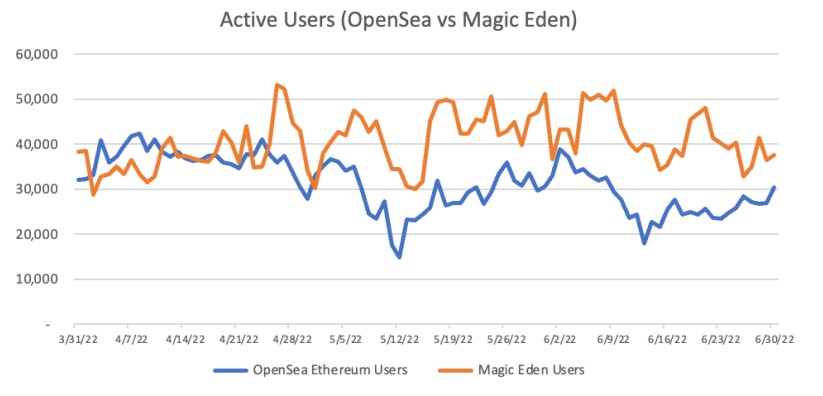

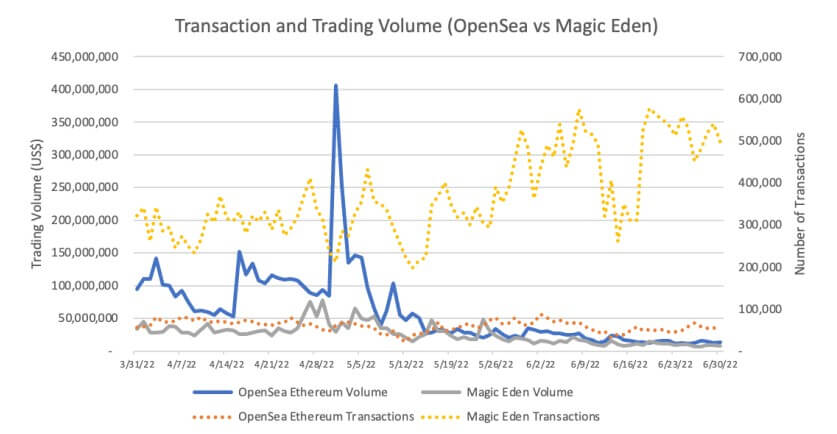

In comparison to OpenSea, the number of active users on Solana who are engaging in NFT-related activity is also healthy. Although the value of the transactions is comparable between the two ecosystems, the number of transactions that take place on Magic Eden is over five times more than those that take place on OpenSea.

As a result of the report’s contention that “Solana has been catching up with Ethereum with its number of DAOs,” there has been a spike in the volume of DAO-related activities.

“As an overview, the decentralized autonomous organization (DAO) construction tool Realms has registered a remarkable surge in the number of DAOs on Solana to over 800+ DAOs at the time of writing, compared to 100+ in January 2022.”

From March to June 2022, the number of DAOs on Solana increased from approximately 1,750 to approximately 2,500, “revealing a successful DAO environment on Solana.” The analysis determined that there was a surge in DAO activity by using the data on the Solana multi-sig wallets.

But All is Not Rosy Rosy

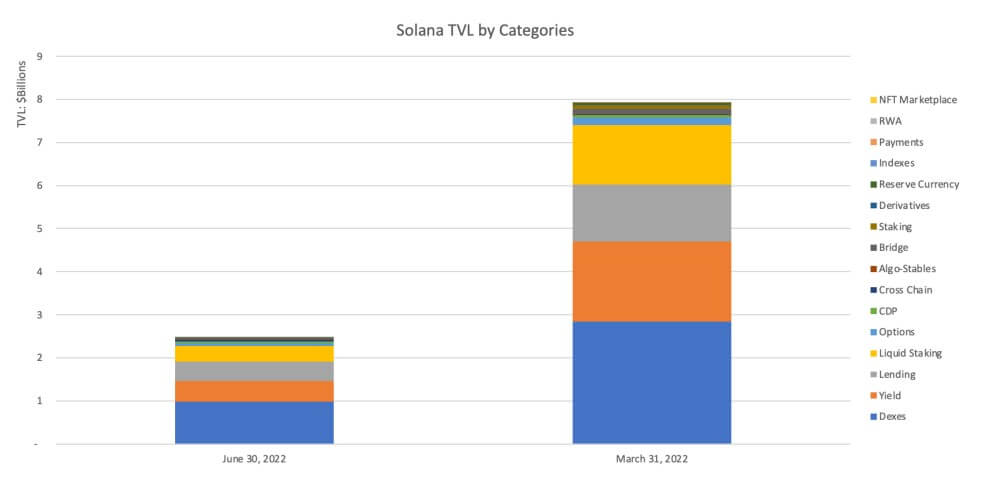

Along with the collapse in the price of the $SOL token, the total value that is locked inside Solana DeFi has experienced a significant reduction, going from $8 billion in the first quarter to barely $2.5 billion in the second quarter.

In addition, while the use of NFT marketplaces may be stable, certain prominent NFT initiatives, such as STEPN, have witnessed a migration of users away from their platform. As a result of an increase in the number of players and a decreased demand for the in-game token in 2022, the value of STEPN’s GST token dropped by 99.5%.

It is important to note that in comparison to the performance of the other chains within GameFi as a whole, Solana has witnessed a rise in market share. According to the research, this is due to “high user statistics from Gameta,” and starting in the second quarter, Solana ranks as a top game chain.

At the end of the study, it was determined that worries regarding the instability of Solana’s network are still prevalent; nevertheless, Bybit is “optimistic that the additional modifications announced during the quarter would increase the network steadiness and lessen the chance of outages in the future.”

More Stories: Jump Crypto Is Developing a Brand New Validator Client for Solana