With the failure of FTX and Alameda before the end of 2017, the cryptocurrency exchange known as Binance, which is currently the largest in terms of daily traded volume and total user base, is the subject of intense scrutiny.

Crypto experts have found malicious transactions within the firm’s wallets, even though the company has published on-chain data to back the measures it uses to determine its reserves.

It has been established that one of them, Binance, was responsible for issuing BEP20 and BEP2 tokens sans providing the necessary collateralization.

As a result, it will leave its clients holding crypto tokens not backed by money from the original network.

Lately, the issuer of stablecoins, Circle, charged Binance with issuing new USDC on its BNB Chain sans having the assets as collateral and selling it to Binance’s clients without possessing the collaterals.

These events have harmed the reputation of the company among worldwide investors, leading to a transfer of its customers to competing exchanges, particularly DEXs.

Binance and the Details Relating to Its Reserves Are Being Inspected

According to a story (1) published by Forbes, last year, Binance transferred nearly $1.8 billion of collateral intended to support the USDC stablecoins held by its clients to various hedge funds, including the now-defunct Alameda and Cumberland/DRW.

According to the reports, the corporation moved the cash reserves without giving the clients sufficient notification.

Binance, on the other hand, has stated that the capital transfer was one of its routine operations and did not result in any difficulties for the platform’s traders.

Patrick Hillman, who serves as the chief strategy officer for Binance, reaffirmed that the transfer of funds between users’ wallets is a standard procedure that the company often carries out.

Hillman explained that the funds were not mixing by saying that “there are wallets, and there is a ledger.”

A spokeswoman for Binance stated that the exchange has never invested the assets of its users without first obtaining their agreement, as required by the rules of certain products.

“Binance stores all of its clients’ assets in segregated accounts which are identified independently from any accounts used to hold assets belonging to Binance,” a spokeswoman for the business stated (2). “Binance does not have access to any accounts used to hold assets belonging to Binance.”

The spokesman further stated that the transactions that Forbes discovered were connected to maintaining the company’s internal wallets and did not influence the collateralization of customer assets.

“Even though Binance has admitted in the past that the wallet management methods for Binance-pegged token security weren’t always flawless, the collateralization of client assets was never compromised at any point.”

The procedures for handling our collateral wallets have been improved over the longer period, and this can be verified on the chain, as the representative mentioned.

Importantly, the business has recognized that the original coins on their smart networks did not always back BUSD stablecoins.

Recent Regulatory Shadows on Crypto

The bitcoin market is about to be subjected to intense scrutiny from regulators to assure widespread adoption.

The primary motivation behind the efforts of many global authorities to regulate centralized exchanges is the need to safeguard investors against exploitative practices.

As a direct consequence, it is anticipated that the cryptocurrency winter will last over the subsequent quarters before any clarity is reached.

In addition, through its Securities and Exchange Commission (SEC), the United States plans to classify all digital assets as unregistered securities, except Bitcoin. Bitcoin will be the only exemption to this rule.

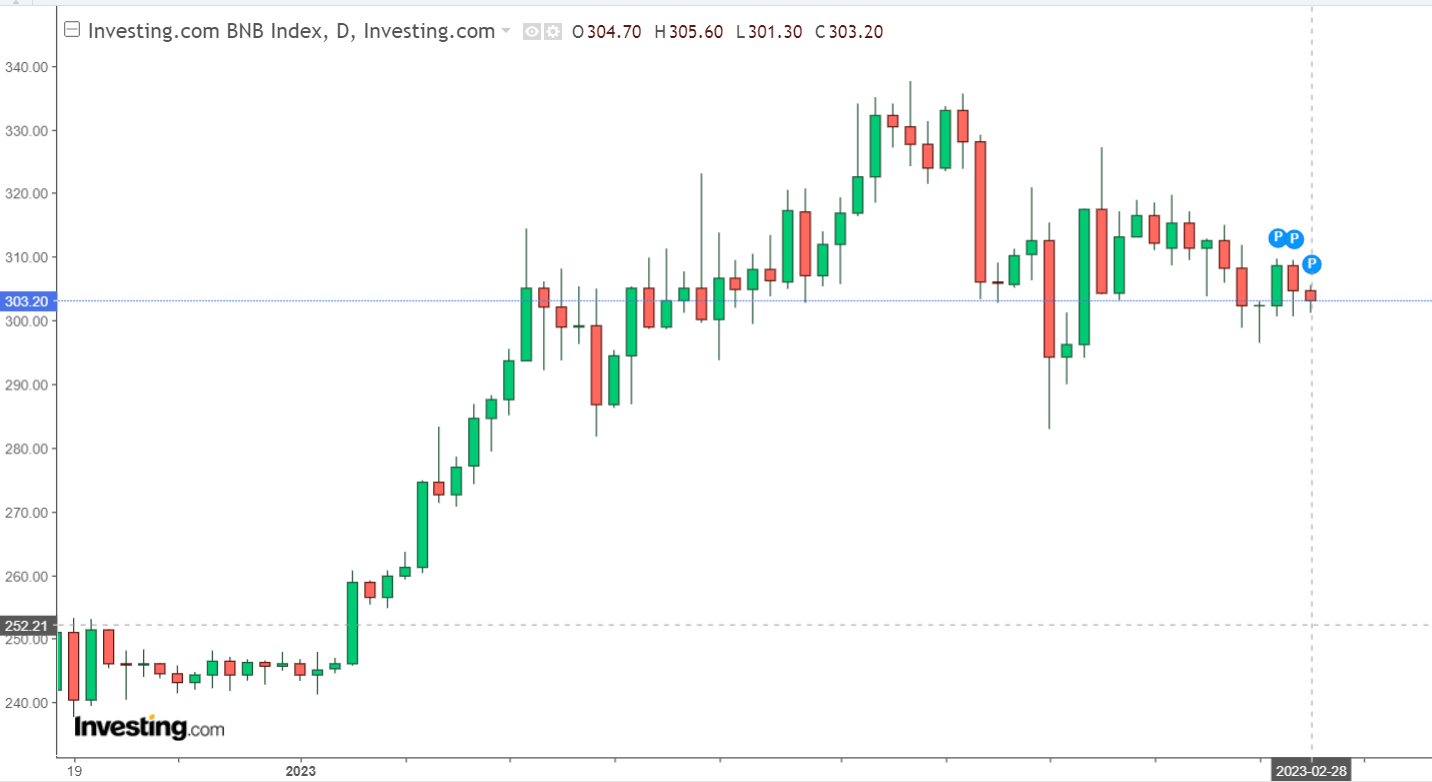

Meanwhile, BNB, the native token of Binance was last seen trading at $ 303.20, 0.49% lower than it closed 24 hours ago.