On October 18, around 50,000 Bitcoin (BTC) were removed from Coinbase, marking the first time since June that such a significant volume of the flagship asset has departed the exchange.

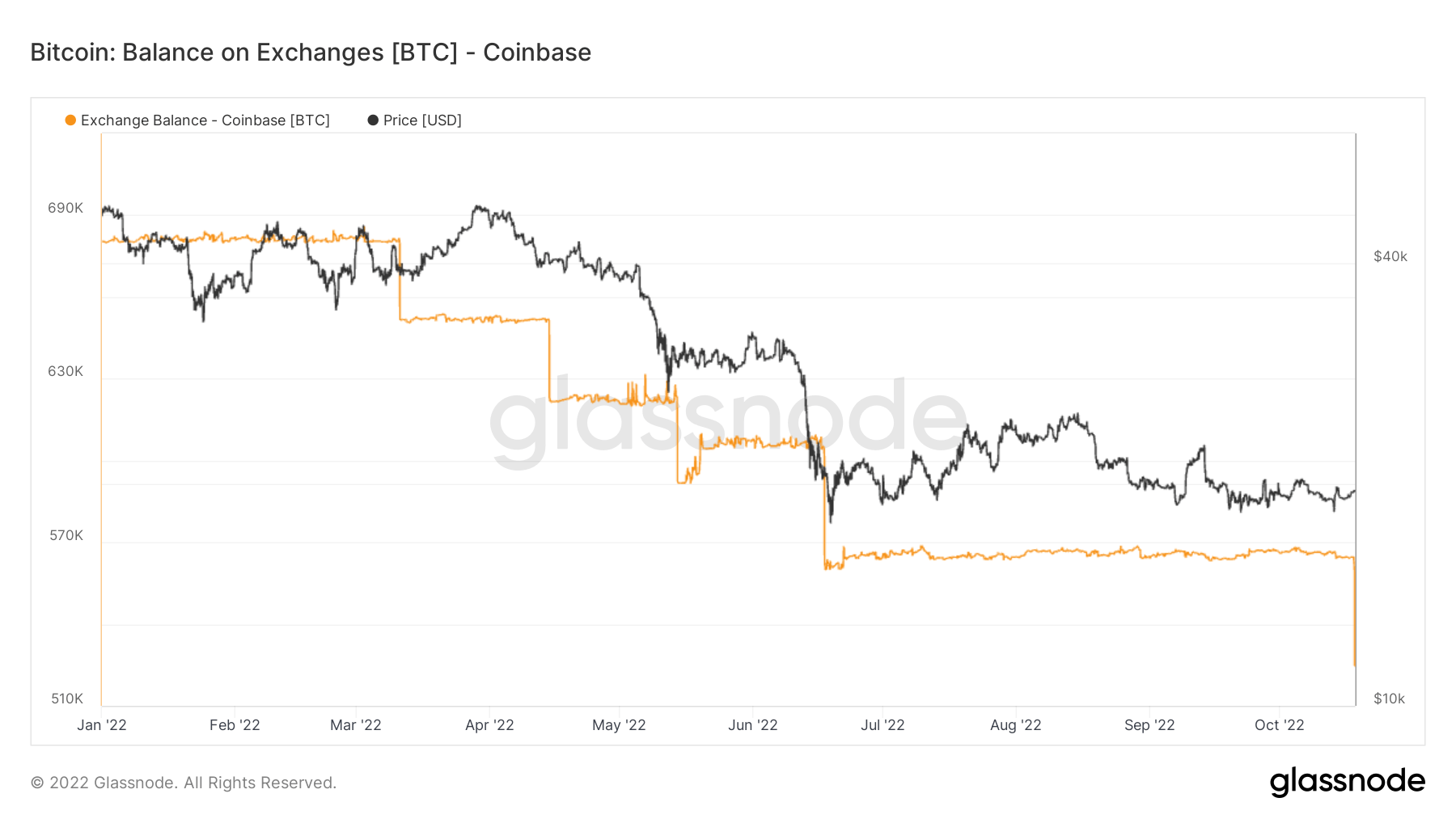

The orange line in the following graphic depicts the number of Bitcoins that customers have withdrawn from Coinbase since the beginning of the current year.

Since late March, the graphic indicates that Coinbase has been seeing a gradual decrease in its amount of Bitcoin reserves. The only time that withdrawals picked up speed was after the Terra-Luna crash, which brought about the chilliest winter in the history of cryptocurrencies.

Because of this, Coinbase’s reserve was reduced to approximately 525,000 Bitcoins, a decrease of 22% compared to the over 680,000 Bitcoins that it had at the beginning of the year.

More Stories : The Lazarus Group of North Korea Targets Japanese Crypto Companies

It’s Not only Coinbase, either!

Although Coinbase was the most recent cryptocurrency exchange to suffer a loss from Bitcoin, other cryptocurrency companies face the same challenge.

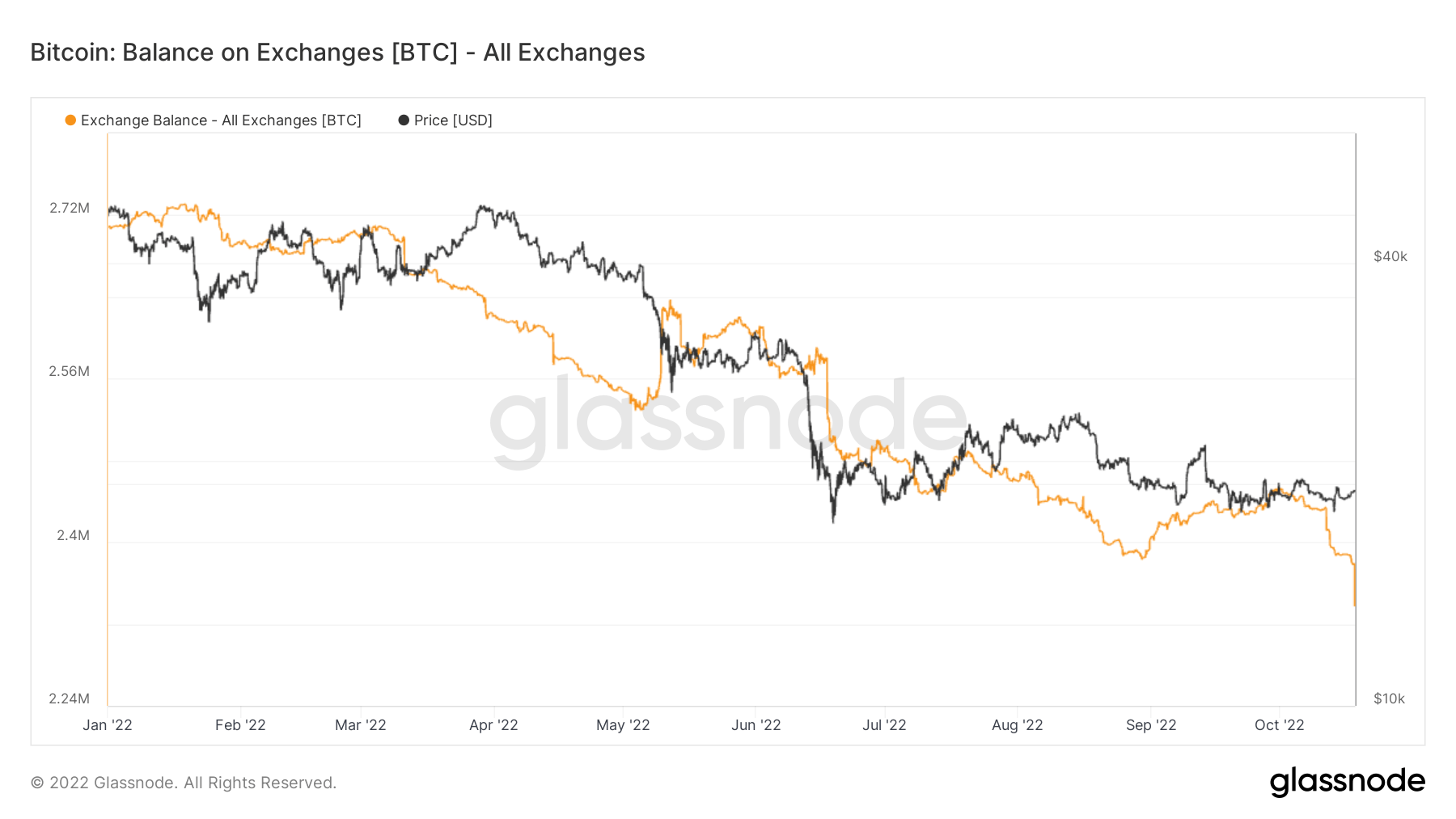

The Bitcoin balances held by all cryptocurrency exchange platforms are depicted in the chart located above. Since the beginning of the year, this chart and Coinbase have shown a consistent reduction.

In January of 2022, about 2.27 million Bitcoins were traded through various exchanges. As of the 18th of October, the total is just a little higher than 2.23 million, which is a decrease of 14.7% compared to where it was at the beginning of the year.

In spite of the gloomy attitude that has dominated the market since May, the rate of decline has remained constant.

Binance is an Exception!

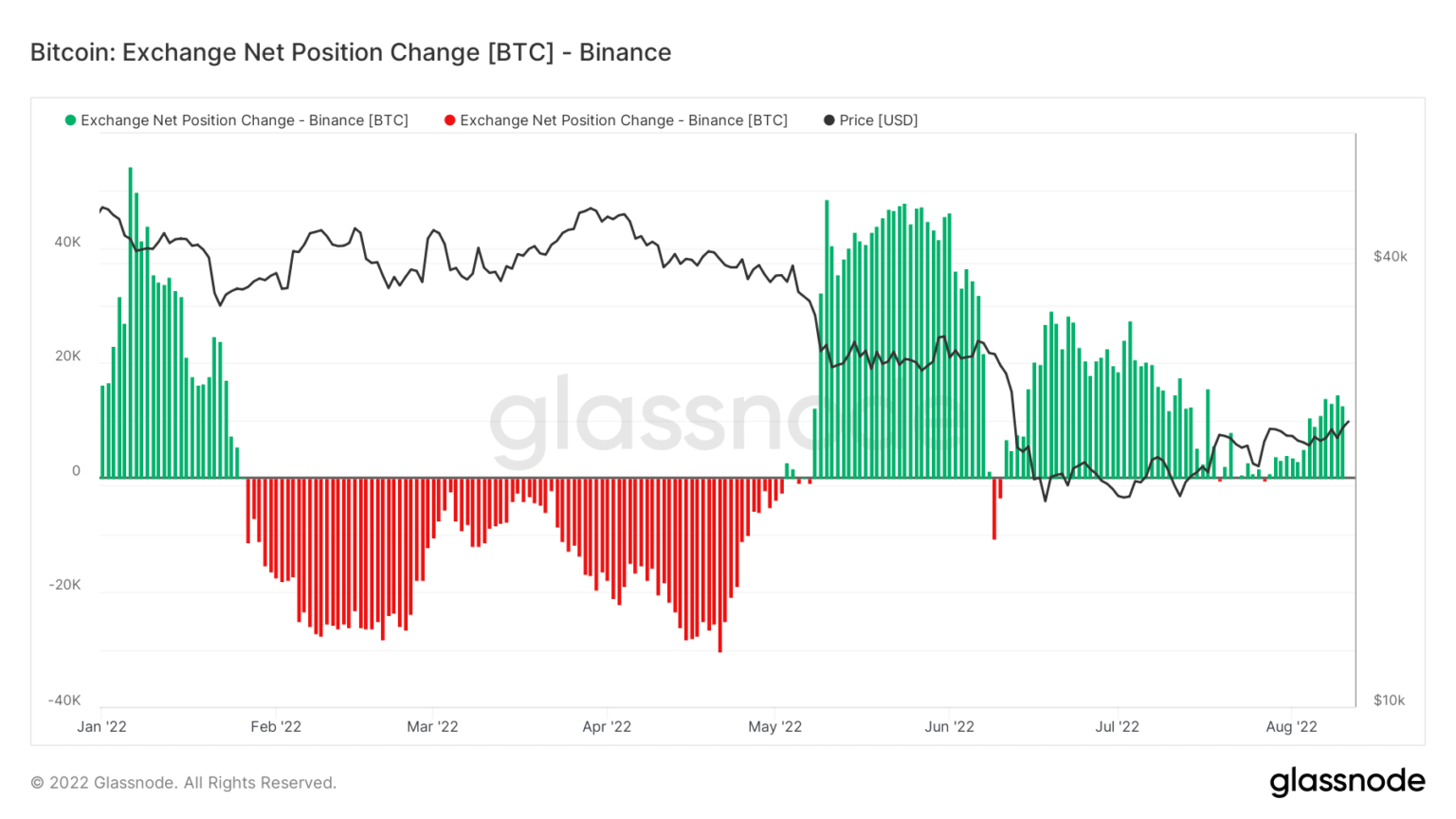

Binance, a major cryptocurrency exchange platform, appears to be an exception to the trend of exchanges losing bitcoins. A study from CryptoSlate that was published in August stated that the only time that Binance experienced a loss of bitcoin was during the months of February and May.

Just prior to the beginning of the bear market, significant Bitcoin withdrawals were made from Binance. Coinbase’s Bitcoin holdings did not fluctuate at all during the months of February and March, which were months of losses for Binance.

Following the onset of the bear market in May, Binance began amassing Bitcoin, while Coinbase and every other exchange suffered major losses in terms of cryptocurrency.