Circle, the company that issued the USDC stablecoin, said late Friday that it still has about (1) $3.3 billion in reserves at Silicon Valley Bank out of a total of $40 billion. Once a panicked public rushed to withdraw their money from the high-tech lender, the stock price plummeted.

On Friday, 48 hours after one capital crisis sparked the second-largest fall of a US commercial bank in history, Silicon Valley Bank collapsed, shooting tremors through the crypto and worldwide markets.

USDC is the 2nd biggest stablecoin, with a circulation of $43.5 billion supported by government bonds and cash equivalents.

Government Officials Order Silicon Valley Bank to Close

This Friday, the market cap for USDC fell to $42.4 billion, per data from CoinMarketCap. Because of apprehension over its reserve levels, the USDC likewise de-pegged from $1.

According to a news release by the Federal Deposit Insurance Corporation on Friday, California regulatory agencies have closed Silicon Valley Bank and assumed control (2) of the lender’s deposits.

According to published sources, the FDIC has established a new bank, the National Bank of Santa Clara, to handle all of SVB’s assets.

SVB, headquartered in Santa Clara, is the sixteenth biggest bank in the United States, with an estimated $209 billion in assets as of the end of 2022.

On March 10, Circle attempted to shed light on the situation by tweeting:

1/ Following the confirmation at the end of today that the wires initiated on Thursday to remove balances were not yet processed, $3.3 billion of the ~$40 billion of USDC reserves remain at SVB.

— Circle (@circle) March 11, 2023

According to its most recent audit, Circle has approximately $20 billion in reserves stashed across several banks, including the recently insolvent Silvergate and the defunct SVB, as of January 31. Hence, worries over USDC increased later this week.

USDC de-pegs from the US dollar

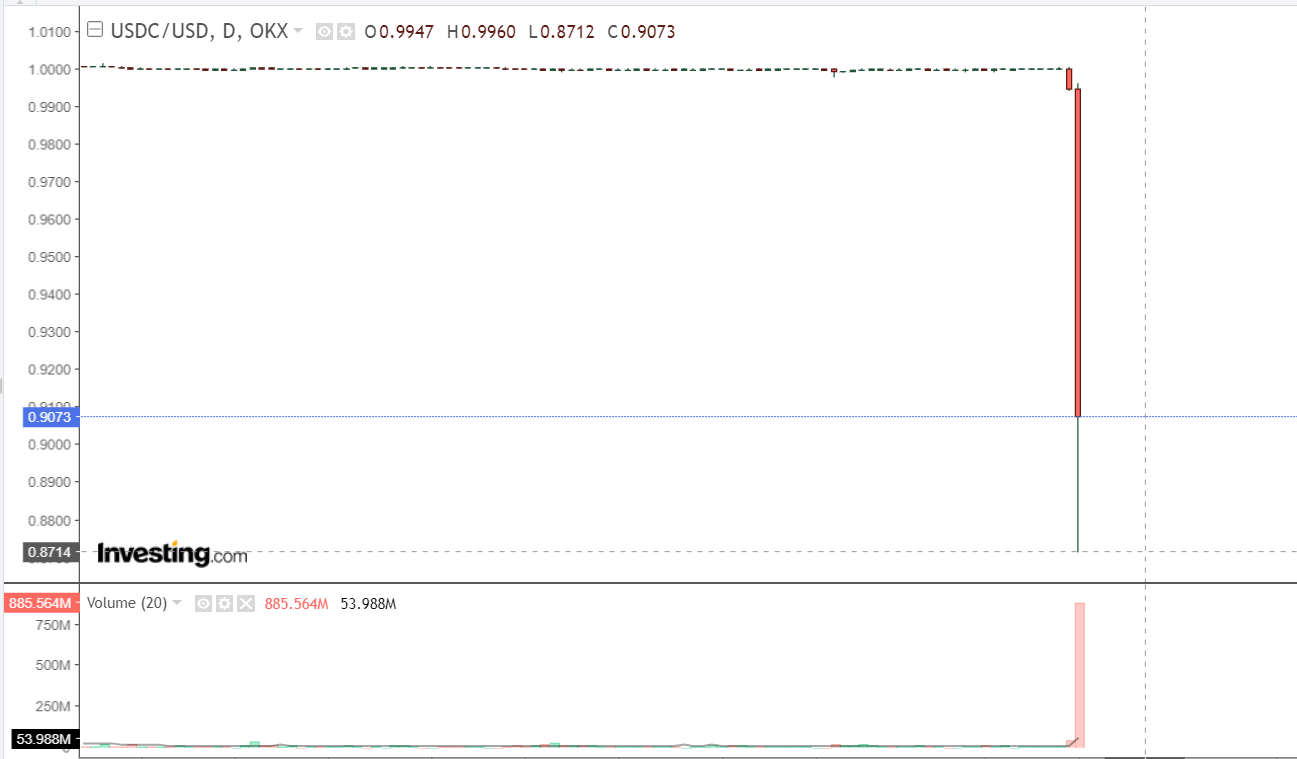

The value of one US dollar coin fell to $0.8714 on Friday night in New York. Stablecoins like USD Coin are based on the idea that their value will always be equal to that of a widely traded currency like the US dollar or the Euro. At the time of writing, it was seen at $ 0.9073.

Circle’s token is second in circulation only to Tether’s USDT, which has nearly $40 billion.

At the time of writing, the circumstances surrounding the rapid demise of SVB were unclear. Still, it appeared that the US Federal Reserve’s unrelenting increase in interest rates in the past year, which had clamped economic position in the start-up segment wherein SVB was a notable participant, were among the main causes of the bank’s closure.

SVB announced on Wednesday that it would be selling $2.25 billion in new shares to improve its balance sheet after selling certain securities at a loss.

As a result, and out of panic, the leading VC firms reportedly ordered their portfolio companies to withdraw their funds from the bank immediately.

What Can We Expect Next?

When SVB’s stock dropped on Thursday, it dragged down the value of other banks’ shares.

The company had already given up on quickly raising capital or finding a buyer, and stock trading had been suspended by Friday morning.

On the other hand, Circle just announced that it was “working on an internal response,” while other cryptocurrency companies issued comments denying any connection to Silicon Valley Bank.

The following was posted to the company’s official Twitter account on Friday night:

Silicon Valley Bank is one of six banking partners Circle uses for managing the ~25% portion of USDC reserves held in cash. While we await clarity on how the FDIC receivership of SVB will impact its depositors, Circle & USDC continue to operate normally.https://t.co/NU82jnajjY

— Circle (@circle) March 10, 2023