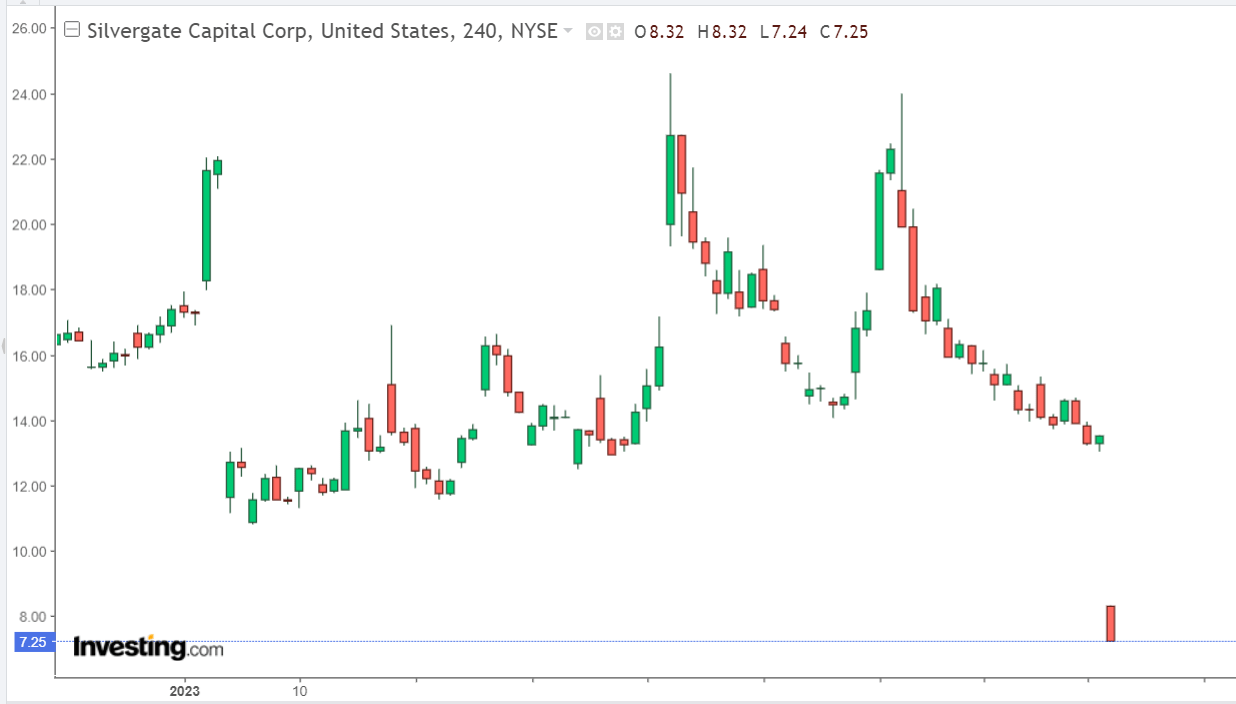

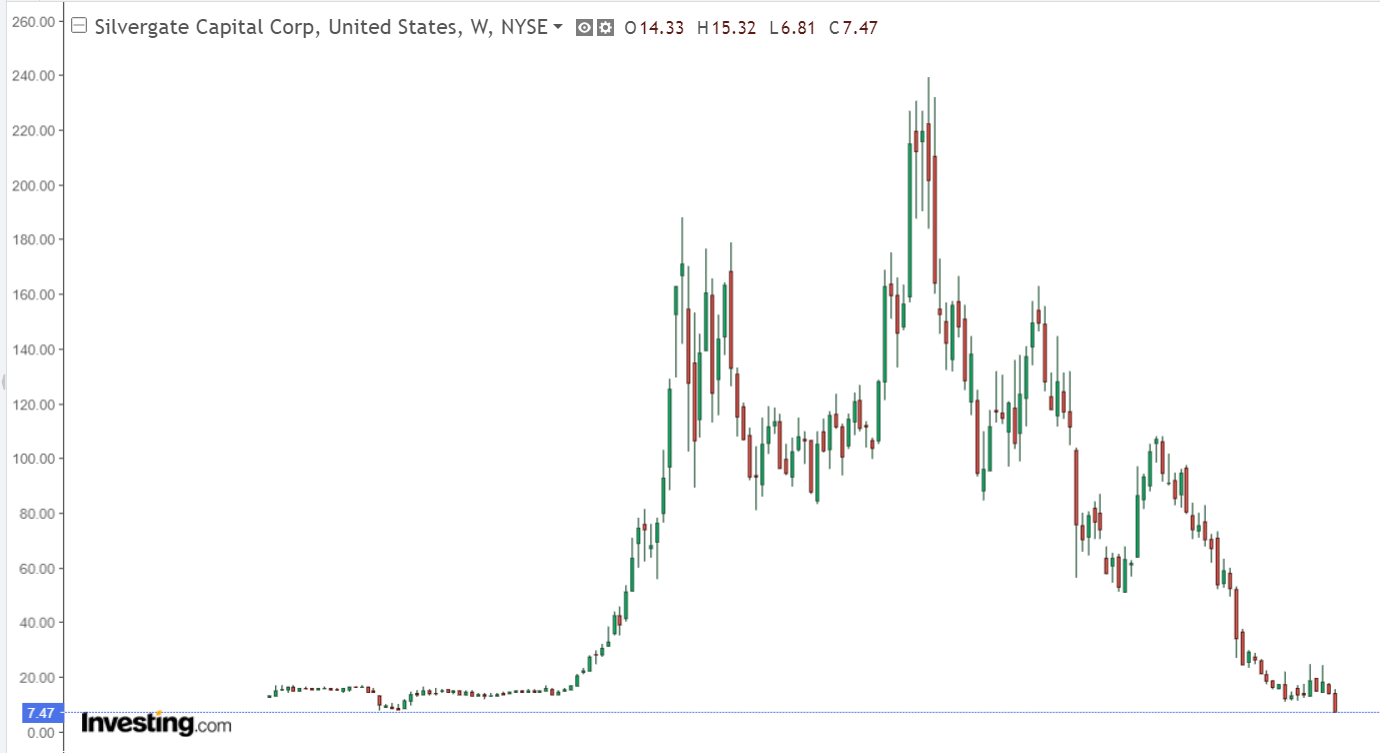

Following the announcement that the cryptocurrency-friendly bank may be subject to regulatory inquiries, Silvergate shares fell by more than 44% percent at the start of trading! This level was seen three years back in 2020!

Because of the investigation, Silvergate Capital said yesterday that it would be delaying (1) the release of its annual report.

After the failure of FTX in November, there has been growing anxiety regarding the bank’s well-being over the past few months.

During this time, Silvergate disclosed that the company’s current depletion of its stock and regulatory probes could lead to a further decline in its overall financial health.

In addition to potential limits brought on by litigation, the California bank warned that it could have difficulties maintaining customer relationships.

The filing of Silvergate’s annual 10-K report has been delayed due to the falling stock price and ongoing regulatory investigations.

Silvergate disclosed that it would require more than two additional weeks to complete the filing of its 10-K report for the fiscal year 2022. According to the filing, the regulatory scrutiny that the corporation is currently subjected to comes from various sources.

These sources include Congress, the Department of Justice, and bank authorities. The bank further elaborated on a potential disparity between the company’s actual outcomes and the representations made regarding such results.

The accounting company for Silvergate, as well as independent auditors, have asked for additional information.

The bank believes that the continuing events’ impact could adversely affect its capacity to continue operations without any disruptions.

DOJ Inquiry over FTX Dealings

At the beginning of the previous month, it was reported that the DOJ was investigating Silvergate for its association with FTX.

Although the topic of the investigation seemed to be based on conjecture at the time, there was no doubting Silvergate’s tight ties to the cryptocurrency exchange that has since closed its doors.

The investigations conducted by the DOJ aimed to determine whether or not the cryptocurrency bank had any kind of fraudulent connection with FTX, particularly with Silvergate accounts that were tied to SBF.

In addition, the detectives want to find out how much the cryptocurrency bank knew about the alleged scheme that FTX had in place to deceive investors.

Reports surfaced in February indicating that Silvergate’s stock was the second most shorted stock in the United States.

During that period, 72.57% of the bank’s equities were sold short on the market in the United States, which reflected an extremely pessimistic opinion.

The Second Most Shorted stock in the US

The stock of Silvergate Capital has dropped by an astounding 85% over the previous year. The company’s shares came under increased selling pressure after FTX’s downfall, and recent investigations have made the situation much worse.

The crypto bank’s share price decrease has also occurred in the context of the broader tech selloff in the previous year. As the crypto winter continued, a number of IT stocks, as well as their values, saw precipitous drops or went bankrupt.

The values of digital currencies, such as Bitcoin (BTC), also fell, with one point seeing Bitcoin’s price fall below the $20,000 level.