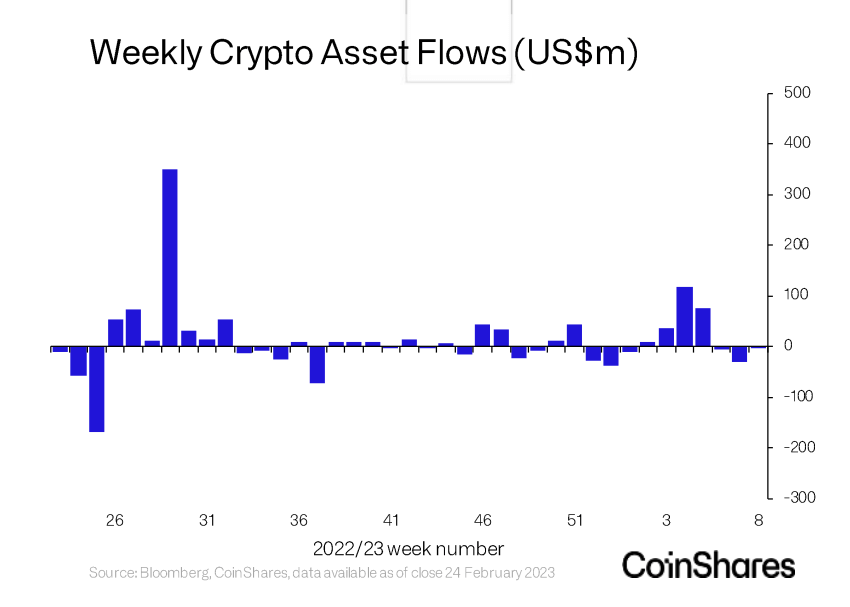

Although asset withdrawals remain the predominant market trend, the cryptocurrency industry has not yet emerged from a period of increased volatility.

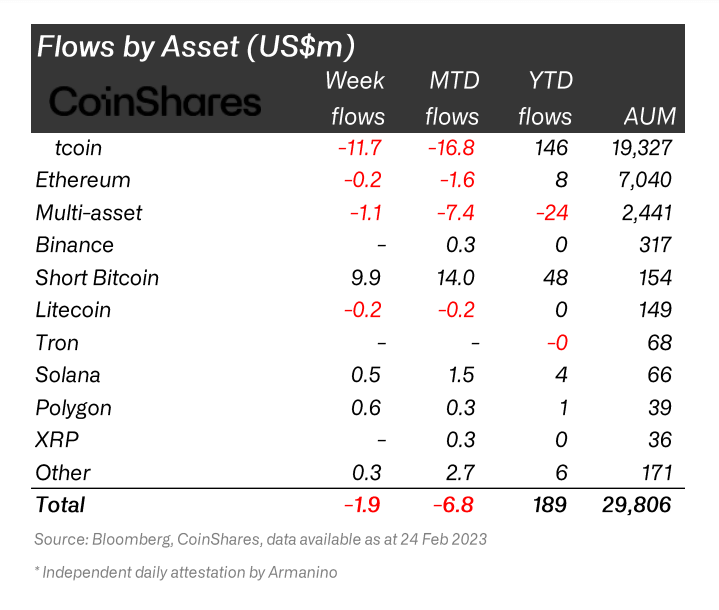

Bitcoin saw a loss of value for the third week in a row, even though its price is gradually increasing. According to the data (1) provided by CoinShares, the withdrawals totaled $12 million during the previous week, while the inflows hit $10 million.

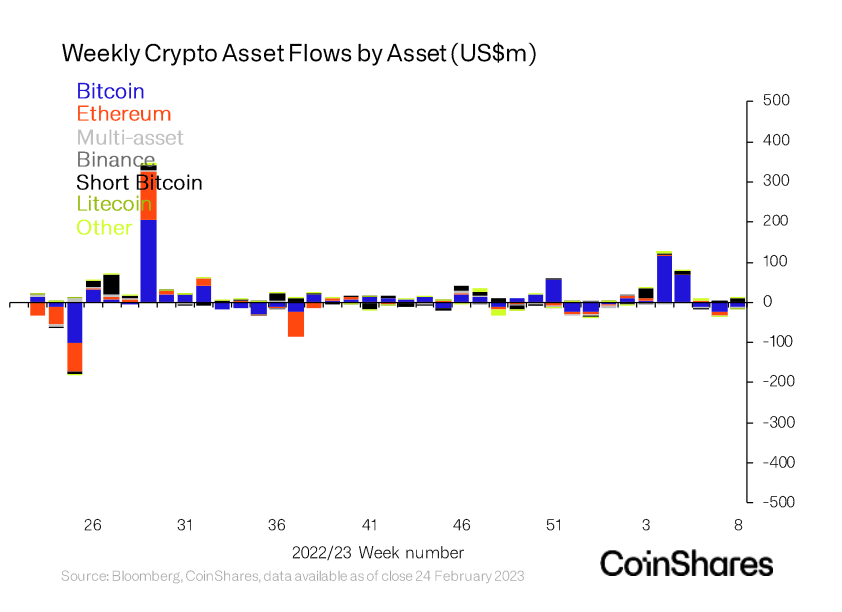

Although the withdrawals of $2 million aren’t very significant, the quantity of money that came in is. The entire ten million dollars flowed into cryptocurrency investment instruments that short Bitcoin was invested in such products.

Ethereum was unaffected by the recent market volatility, recording only $200,000 in withdrawals over the previous week. On the other hand, Polygon (MATIC), Solana (SOL), and Cardano all saw tiny deposits during the same time period (ADA).

The spike in short-bitcoin inflows can be explained by the heightened pessimism that has been observed in the United States. As a result of the highly anticipated FOMC meeting that took place the previous week and the Federal Reserve’s presentation of macro data that was better than anticipated, traders in the nation are becoming overly worried.

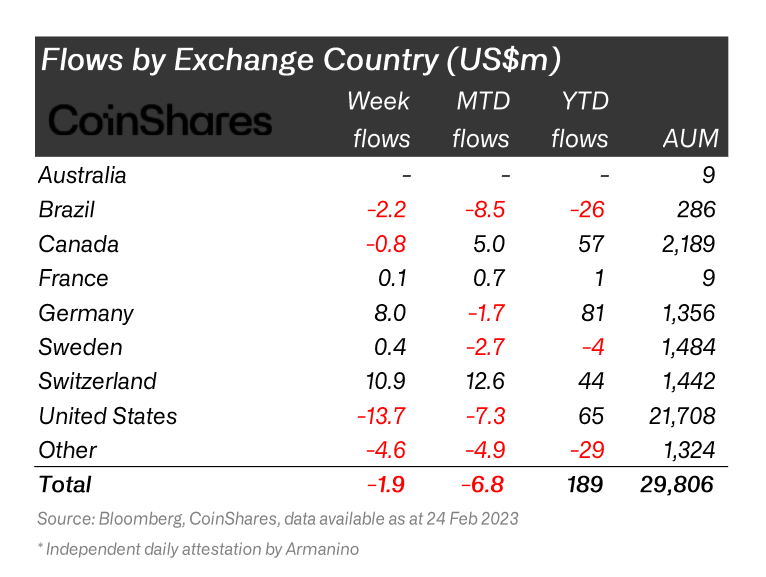

The vulnerability of the U.S. market to legislative crackdowns is likely the primary reason for the enormous disparity between the outflows witnessed in the United States and those seen in the rest of the globe.

Following a statement or enforcement action taken by government entities, less regulated markets are much less likely to experience major capital outflows or an increase in short positions.

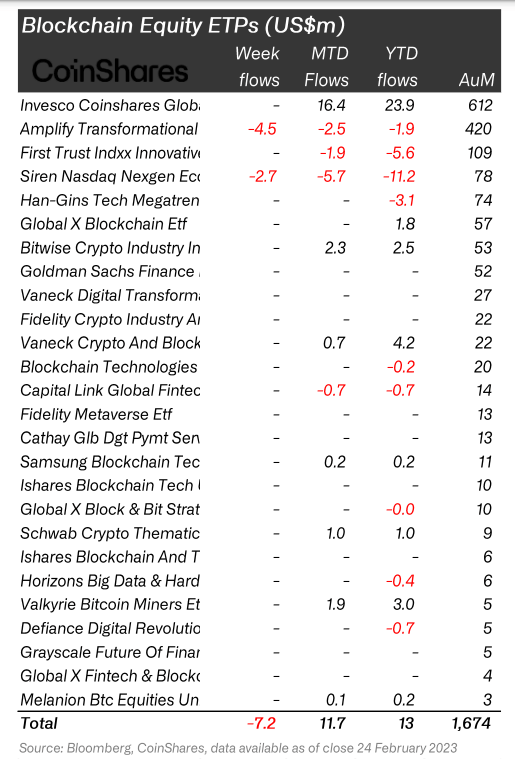

This is very clear when looking at blockchain stocks, which are regulated commodities that investors can purchase in the United States and Canada. They were also affected by negative sentiment, which resulted in outflows of $7.2 million.

Since reaching their apex in November 2021, officially listed blockchain firms have become more vulnerable to market swings.

Most publicly traded blockchain companies are primarily concerned with expansion, which means that even minute shifts in interest rates can make them susceptible to volatility and make them vulnerable.

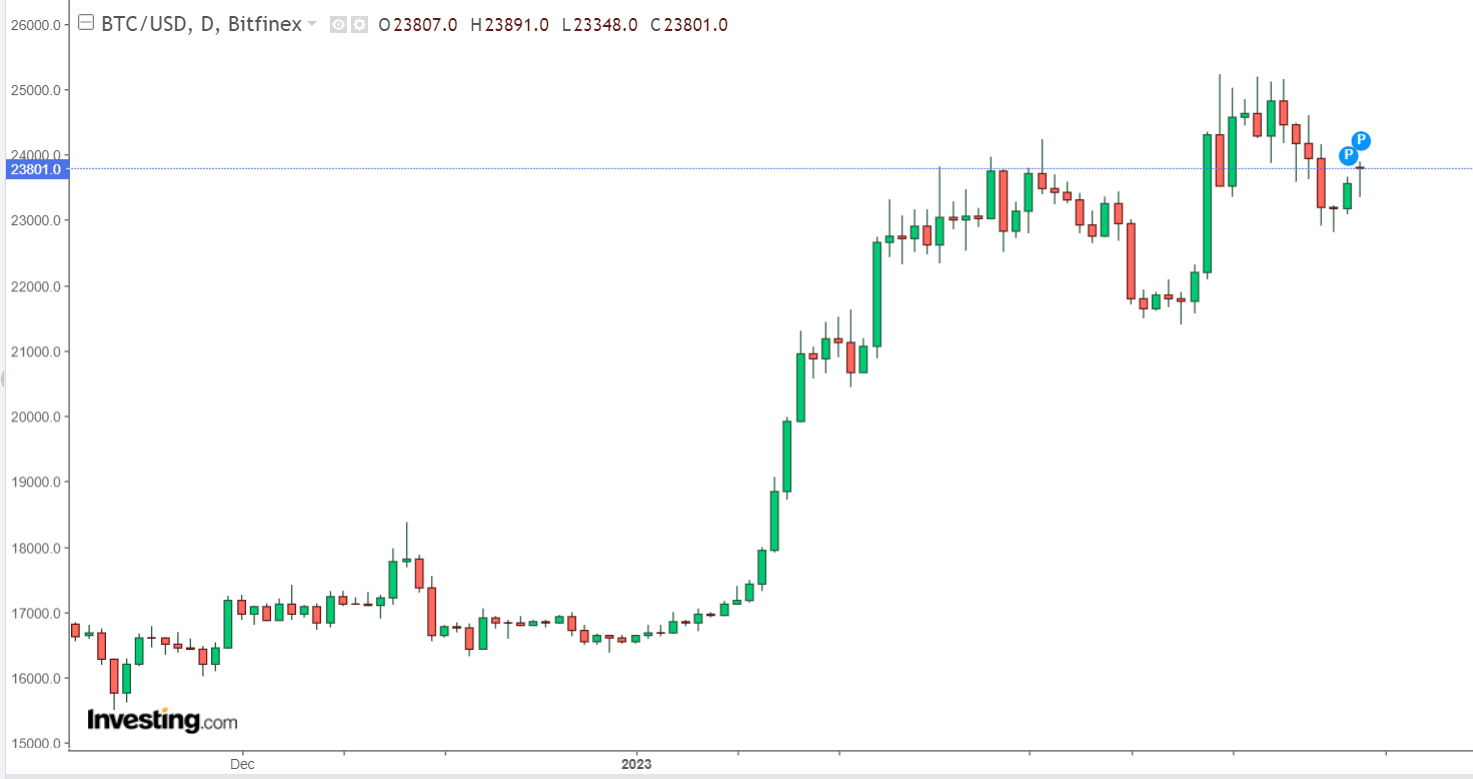

Bitcoin Price

At the time of writing, Bitcoin was trading at $ 23,801, up 1% from the last day’s close.