In response to concerns raised by a bank that specializes in digital assets over the long-term viability of the Silvergate Exchange Network (SEN), Silvergate Capital has decided to shut down the Platform.

One of the bank’s most popular services is SEN, a platform for making crypto payments. The program allowed investors and cryptocurrency exchanges to make transfers whenever they wanted, unlike traditional bank wires, which could take several days to clear.

As the level of unpredictability has increased, Silvergate’s customers have begun to disassociate themself from the bank.

The company has been urging customers to invest their money elsewhere while reassuring them that their money will be safe.

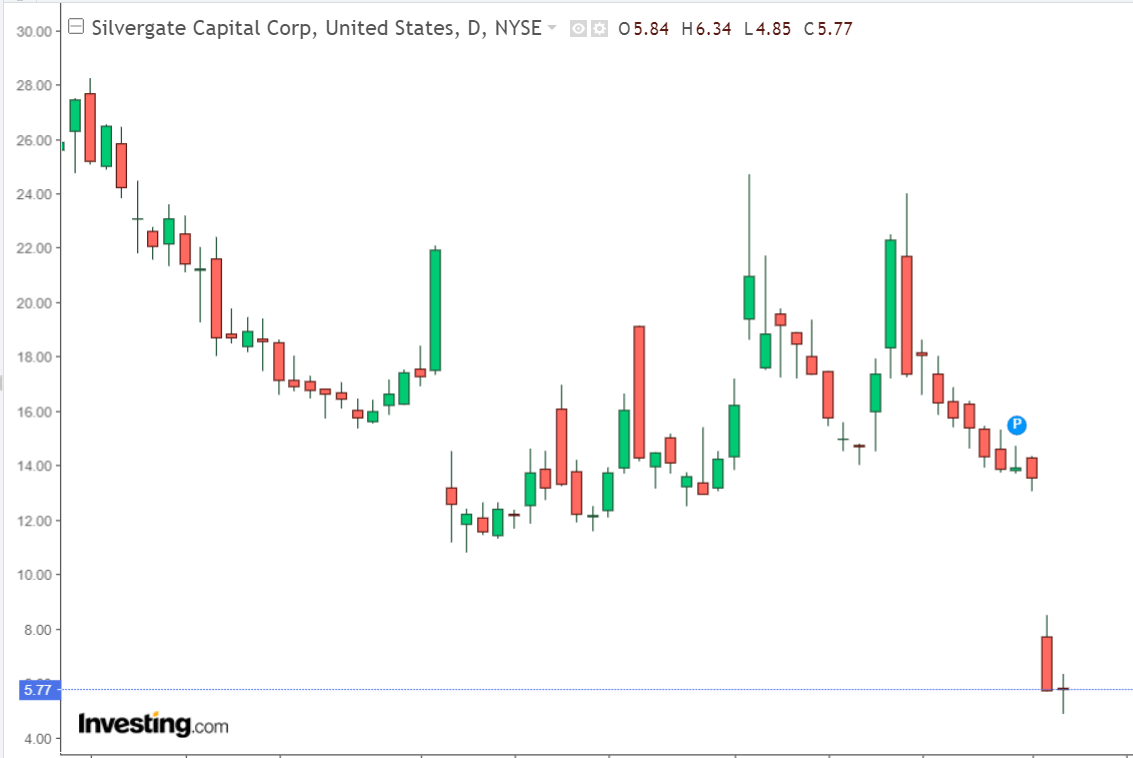

Silvergate shares grounded to $ 5.77 as of the last snapshot of the price.

The cryptocurrency bank revealed (1) in a filing that it might need to reevaluate its capacity to continue operations after reporting a loss of one billion dollars at the conclusion of the previous quarter and additional losses in January and February.

The bank accepted in the same declaration that it had been the focus of interrogations by authorities concerned and the United States Department of Justice.

The bank also stated that it was uncertain whether or not it would be able to continue operating as a “going concern” over the following year.

The following day, several important cryptocurrency clients departed the bank, including industry heavyweights Galaxy Digital and Coinbase. The bank’s stock price plunged by over sixty percent before leveling off on Friday.

Authorities Fired the Warning Signal

The Platform was taken offline after the banking authorities who regulate the financial institutions gave multiple warnings to those institutions about the dangers linked with crypto holdings, including volatility.

As per experts, exposure to cryptocurrencies comes with its own risks. In contrast to traditional investments, cryptocurrencies are decentralized and highly unregulated. As a result, investors in cryptocurrencies are susceptible to both market turmoil and fraud.

Because cryptocurrencies lack the security of traditional financial systems, their prices are more prone to quick and dramatic swings than traditional currencies are. Furthermore, the safety of crypto exchanges and e-wallets can be breached, which can result in the loss of assets.

Before committing cash, investors should carefully assess how much risk they are willing to take and conduct extensive research on any cryptocurrency investments they are considering.

When considering an investment in this fast-changing industry, it is essential to understand both the possible risks and rewards.

Silvergate responded in 2017 to the increased demand for digital currency payment options by launching the SEN.

As a result of its capacity to offer institutional investors a payment infrastructure that is all of the following: secure, dependable, and effective in the processing of digital currency transactions, the network has gained appeal.

The financial institution has established itself as a frontrunner in digital currencies by providing various services to facilitate digital currency trading and investing. These services include custody, lending, and forex services.

Before it was temporarily taken offline, the Silvergate Exchange Network was widely regarded as a significant step forward for the digital currency industry.

It offered a reliable and risk-free environment where institutional shareholders and companies could conduct transactions involving digital currencies.