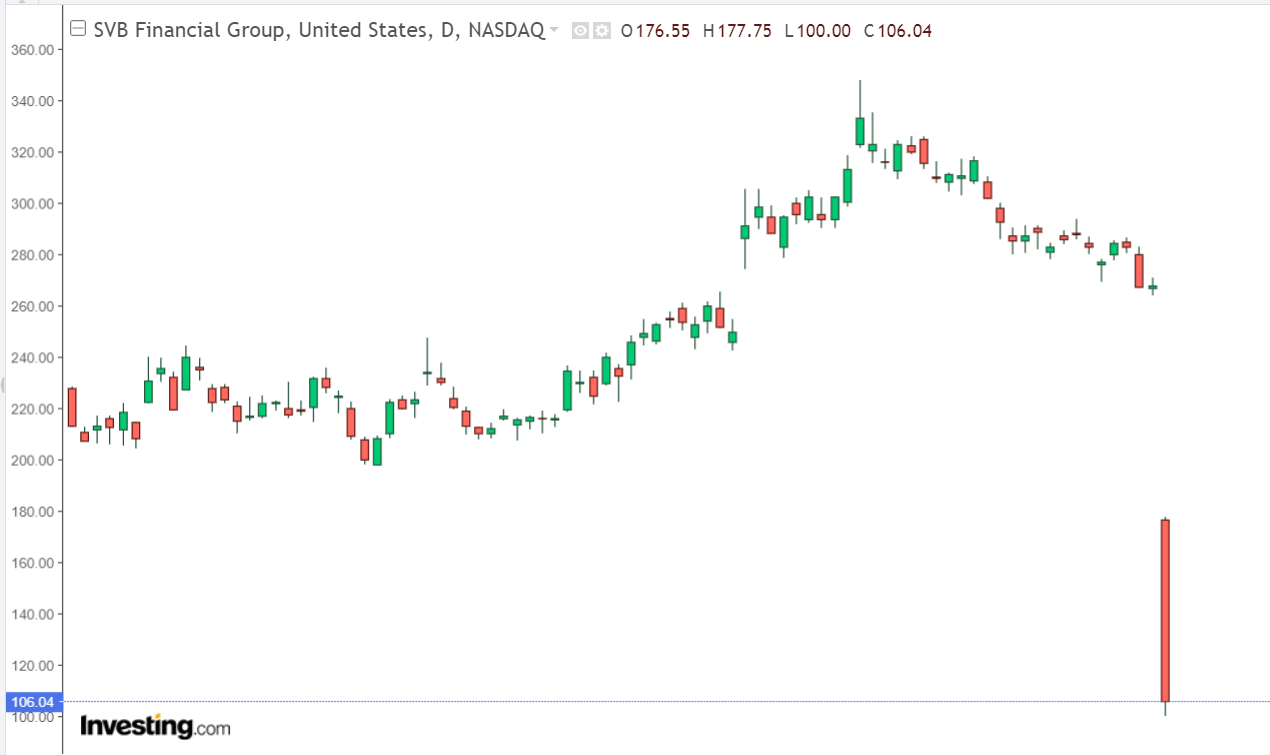

The share price of Silicon Valley Bank, which also operates under the name SVB Financial Group, has dropped by 23.52% in the Pre-Market, after a stunning drop of 60.41% on Thursday. The company is currently experiencing the worst of its days.

Considering the significant drop in the price of the bank’s shares, SVB Financial Group is currently trading at $81.10 during what is considered the most difficult week for the company in about ten years.

The most recent round of fundraising for the corporation consisted of selling 1.75 billion shares, which has put pressure on the stock price.

According to a report (1), the company started the fundraising effort this week. It stated that it intends to utilize the money to help fill the hole of $1.8 billion generated by the sale of a $21 billion huge deficit bond portfolio mostly comprised of US Treasuries.

Even though the company had solid plans for the capital increase, investors were unnerved by the decision since they felt the company may still be unable to make up for the deficit in its bond.

Gregory Becker, the company’s Chief Executive Officer, has been calling the company’s venture capital backers to convince them that their funds are secure with the back in light of the recent selloffs.

Under the condition of maintaining their anonymity, two individuals who are familiar with development commented.

Silicon Valley companies frequently choose SVB as their banking partner of choice. The bank was recognized as the leading lender to around fifty percent of the companies that went public in the previous year.

Investors continue to be concerned that the depreciation of the backs of these companies may not be sustainable in the medium to long term, given the realities of the current economic prospects.

According to reports, investors have begun withdrawing their cash from Silicon Valley Bank in response to the selloff that has been occurring, and sources have confirmed that this move has taken place.

The collapse of a bank into insolvency is a possibility during a run on the bank, which might signal additional disaster for investors.

There Are Some Bright Spots for Silicon Valley Bank

Although the Fear, Uncertainty, and Doubt (FUD) surrounding Silicon Valley Bank may be considered negative press, the financial services company is facing several positive developments as well.

The chief executive officer of SVB Bank is already affirming efforts to balance out the bank’s books, even though an analyst from Wedbush Securities named David Chiaverini did not believe that SVB is in a liquidity crisis.

In addition to reinvesting their existing short-term debt, one of the strategies is to increase their term borrowing to a total of $30 billion.

According to Becker stated in the letter, “we are taking such measures as we predict ongoing increased interest rates, stressed both private and public markets, and increasing capital burn levels from our clients.”

He went on to say that SVB is “fully financed” and that “when we see a restoration to equilibrium between venture investment and cash flows – we will be perfectly placed to enhance profitability and growth”

The problems that SVB is having are similar to those that top cryptocurrency bank Silvergate Capital Corp is having, which is one of the reasons why Silvergate Capital Corp has announced that it will voluntarily close its operations and then liquidate its assets.