After delaying its file with the US Securities and Exchange Commission for an extended period, cryptocurrency-focused bank Silvergate Capital (NYSE: SI) has come under intense scrutiny and pressure.

Because of the failure of FTX, the bank’s health has worsened more quickly, and there are rumors circulating about the possibility of the bank going bankrupt.

MicroStrategy, the company now the world’s largest corporate holder of Bitcoin, has verified that it does not have any custody with Silvergate in light of the recent development.

Relationships between MicroStrategy and Silvergate

Microstrategy successfully secured a loan from Silvergate Bank for $205 million, which was supposed to be repaid in the year 2025.

On the other hand, MicroStrategy stated that even in the event of bankruptcy, the loan terms would not be modified. On Thursday, MicroStrategy mentioned (1) the following in a tweet sent from its Twitter handle:

“We have a loan from Silvergate that does not come due until the first quarter of the year 25. Concerns have been voiced in the market over Silvergate’s current financial situation. Silvergate does not act as a custodian for our bitcoin (BTC) collateral, and we have no other contractual relationship with Silvergate.”

In its statement regarding the future, Silvergate Bank emphasized the possibility that it could come under further regulatory scrutiny in the years to come. The latest happenings at Silvergate Bank have elicited strong responses from various cryptocurrency companies.

After suspending Silvergate Bank as a partner for the US dollar, cryptocurrency exchange Coinbase immediately switched to using its rival, also known as Signature Bank. The cryptocurrency exchange also provided its customers with a note that included the following quote:

“After careful consideration, Coinbase Prime has decided to make some adjustments to our USD banking partners. From immediately, we will be able to facilitate withdrawals and deposits of fiat currency via Signature Bank.

Coinbase has also indicated that it has had very little interaction with Silvergate Bank up until this point. As a result, dissolving this relationship will have a negligible or virtually nonexistent consequence.

The Silvergate Effect Is Beginning to Extend to the Whole Crypto Market

Everyone is discussing whether or not there will be a new FTX episode now that they have heard of the possibility that Silvergate Bank will go bankrupt.

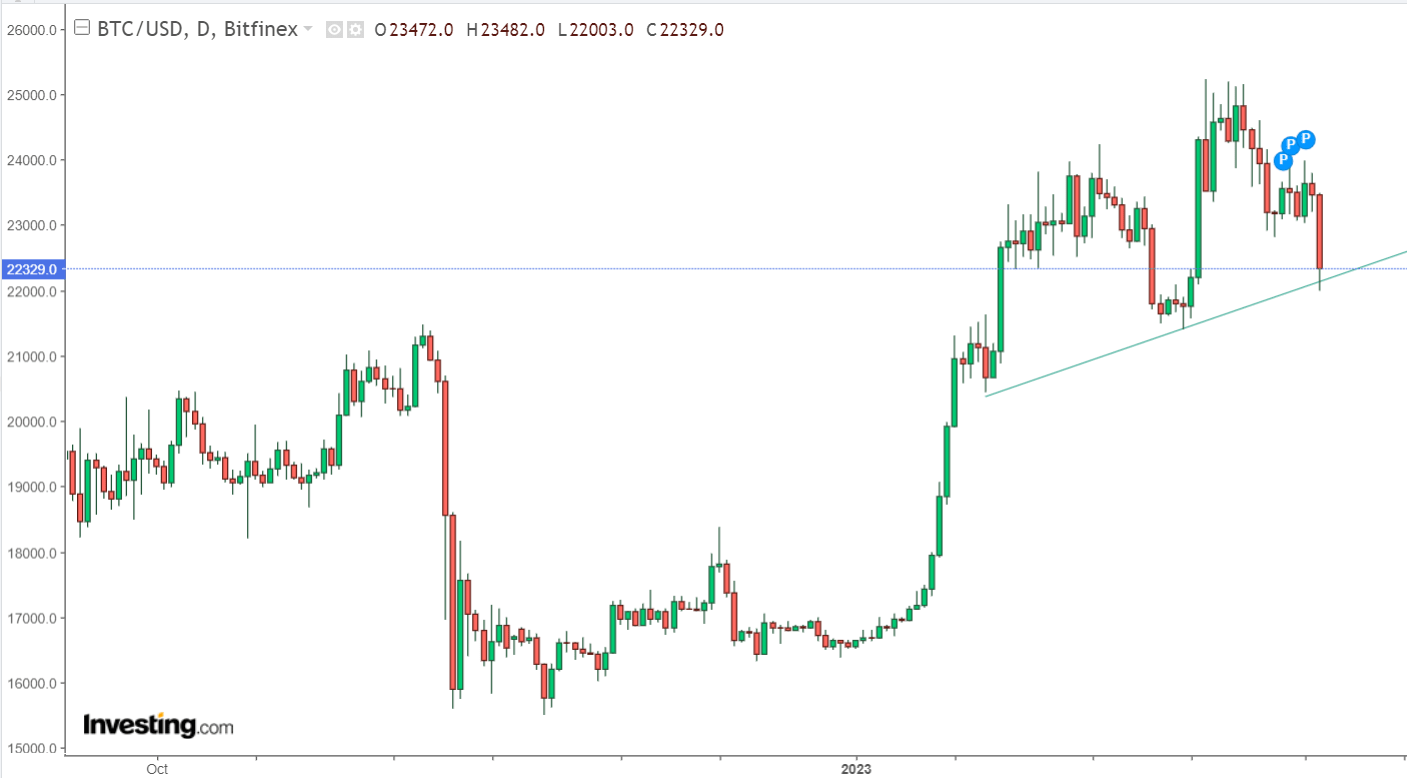

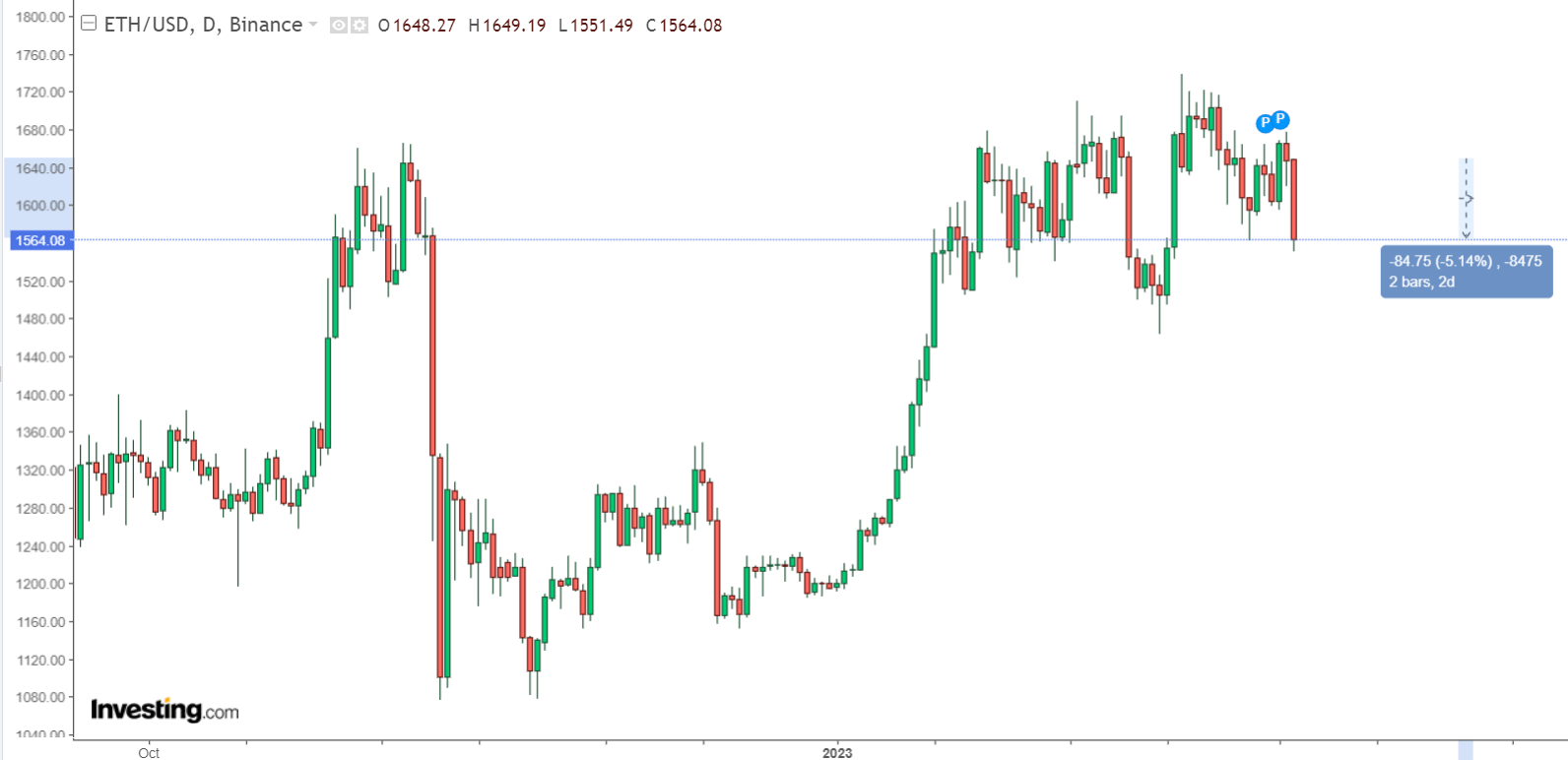

The cryptocurrency market has also been hit by the contagion, which has caused a 5% decline across the board, including Bitcoin.

Around $70 billion worth of investors’ money has been wiped out in the past day as a result of the market decline.

Bitcoin (BTC) is currently trading 4.89% down at a price of $22,329 and has a market valuation of $431 billion as of the time of this writing. Aside from this development, alternative cryptocurrencies have entered a more severe bear market.

The current price of Ethereum (ETH) is $1564, a decrease of more than 5.14% from its previous level. The remaining top 20 cryptocurrencies have all experienced a correction of a magnitude comparable to one another.

On March 2, the share price of Silvergate Capital fell by more than 57% in a single day, reaching a price of $5.72. The value of SI stock has decreased by 95% during the course of the past year.