Developing better networks is one strategy for attracting more investors to the cryptocurrency market. Those that mine cryptocurrencies typically propose various enhancements to the network to increase its effectiveness, fulfill the users’ requirements, and resolve problems that prevent transactions from being completed seamlessly.

In a recent turn of events, Litecoin announced the release of a network upgrade to enhance the cryptocurrency’s network security and address significant vulnerabilities that have been hurting nodes.

On March 2, the Litecoin Foundation publicly announced the update (1), which was given the name Litecoin Core 0.21.2.2.

They disseminated the information on Twitter. Given the recent decline in the price of Litecoin, it would appear that the update is not adequate to maintain miners’ enthusiasm for the network.

Litecoin’s Price Increase And Upgrade Provided Motivation For Miners

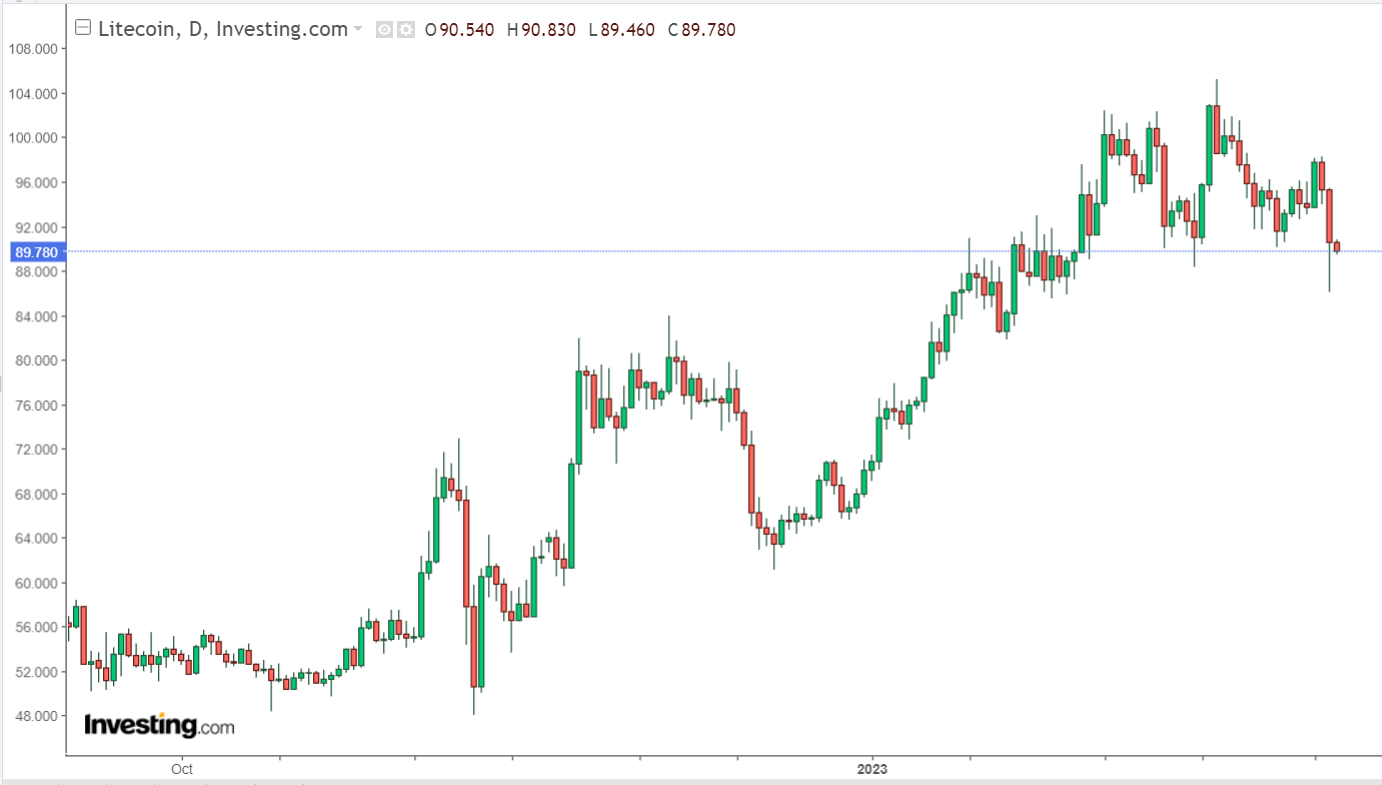

LTC ended 2022 at $68. On the same trading day, it reached an intraday high of 70 dollars and an overnight low of 67.79 dollars. The following day, January 1, LTC started with favorable market fluctuations, which drove its price up to $74 by the end of the trading day.

The upward movement of the coin’s price continued until it reached $90 on January 14 and $101 on February 2. During the period beginning on February 3 and ending on March 3, the price of LTC fluctuated on various days between $80 and $100.

At the time of this writing, the price of LTC on the market is $89, which indicates a little decrease over the past 24 hours. Nonetheless, its trading volume has decreased by 48.42%, indicating less activity with the coin.

Notably, Litecoin Core 0.21.2.2 contributed to accelerating the expansion of LTC mining. According to the data (2) provided by Coinwarz, the network’s hashrate experienced a minor increase, which may indicate that new miners joined the fray.

The recent drop in price could cause miners to lose interest

Yet, there was a time when LTC had a price decline of 7% in just one day, which scared investors. Also, the price is being pushed downward by bears according to the daily chart of this asset. The Relative Strength Index (RSI) for LTC was moving in the direction of going below the neutral mark, and the Chaikin Money Flow indicator also showed a downward trend (CMF).

The fact that the price of LTC has touched the lower section of the Bollinger Bands is another indicator that the market has moved into an area characterized by high levels of volatility.

The MACD also shows a negative trend in the LTC market, which indicates that further bear runs are likely to occur in the days ahead.

Chart indicators for LTC now point to a potential price decline in the near future. The performance of the blockchain is likewise not encouraging, as it appears that its metrics are poor.

One further thing that worries us is that LTC’s volume of daily on-chain transactions has been decreasing. According to Coinmarketcap, Litecoin trades have decreased by 48.56 percent.

Also, demand in the futures market collapsed as a result of LTC recording a significant decrease in its DyDx funding rate on March 3. This occurred on March 3.

The LTC market witnessed unfavorable feelings, contributing to decreased investor confidence.

If the price of bitcoin continues to drop, analysts are concerned that miners may also lose interest in the network. In addition, Litecoin has difficulty climbing higher on the daily candlestick as the momentum swings.