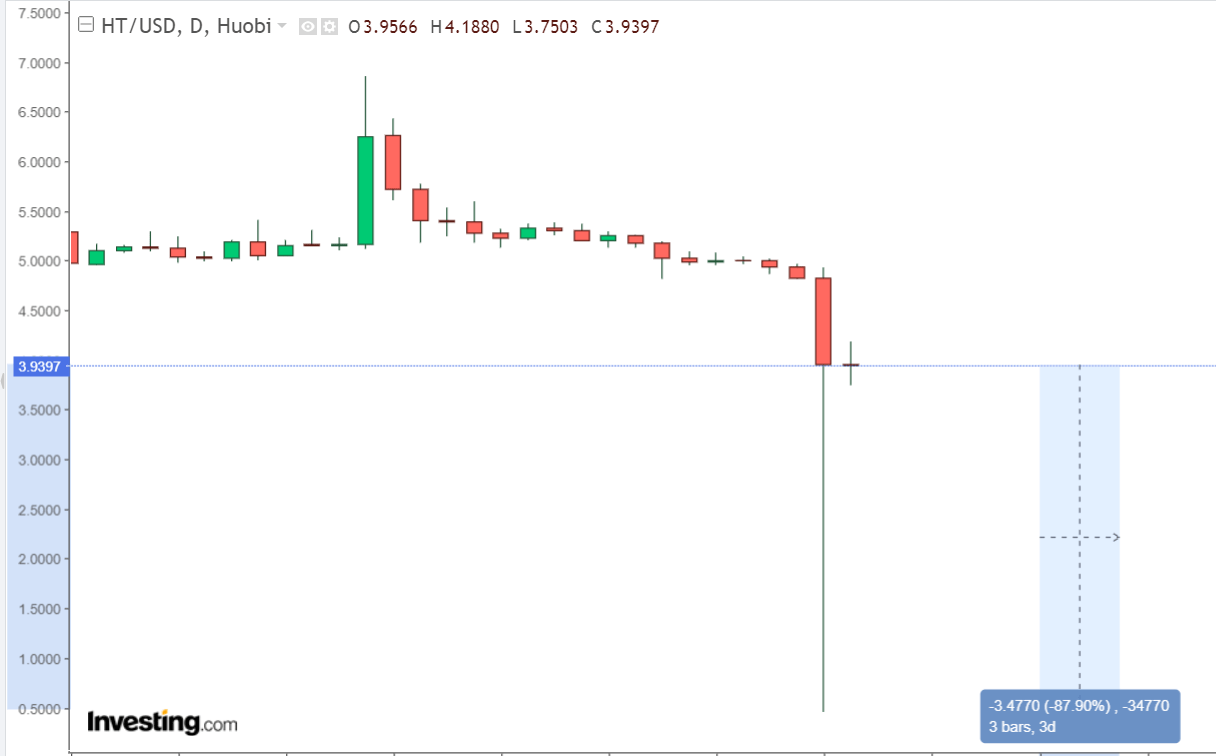

For the past twenty-four hours, interesting price activity has been seen in Huobi Token. This digital currency, which is native to the Huobi Global market, has witnessed a flash crash, which has resulted in its price falling by as much as 93 percent.

During a short period, the value of digital money rebounded to practically the same level as before.

On Huobi, the Huobi Token (HT) reached its lowest point in over a year, trading for as little as $0.455. The coin’s price has fallen by 18.84% since its peak and is currently trading at a spot price of $3.9699.

It is not unheard of for the value of a digital currency to drop by more than fifty percent. The last time such a scenario occurred, the token known as Terra (LUNA) could not make the same comeback from May of the previous year to the present day.

Many analysts are still working on attempting to figure out what went wrong with the HT coin and what caused the enormous flash crash.

When flash falls of this magnitude take to happen, it is technically inevitable that liquidations will take place.

According to statistics (2) provided by Coinglass, Huobi has posted a total liquidation of over $51 million over the previous twenty-four hours.

This pattern is considered an aftereffect of the HT flash crash and the bearish downturn that has gripped the sector as a whole.

Justin Sun, the creator of the Tron Blockchain, who is also affiliated with Huobi, has committed to invest $100 million in order to assist in improving the liquidity pool of the exchange. This is an effort to help alleviate the current crisis.

“We sincerely apologize for the effect that the leveraged liquidation had on the market, which a few users caused,” he tweeted (1).

“In the interest of further enhancing the multi-currency liquidity of the @HuobiGlobal platform, we will establish a liquidity fund with an invested capital of 100 million US dollars,” he added.

The trading desk will “keep making improvements to the liquidity breadth of main cryptos and HT tokens, strengthen leverage risk warnings, and increase liquidity capabilities.”

Concerning this occurrence, we will inform the community about the follow-up progress as it becomes available.

The Huobi Crash and the Impact of the Justin Sun

New statistics (2) from Arkham Intelligence may change people’s opinions, even though some industry analysts and stakeholders have been praising Justin Sun for his reaction and effort to strengthen the exchange.

gm

Justin Sun has been shuffling around some stablecoin positions over the past 24 hours.

He initially withdrew $60M in USDT, USDC and USDD from @HuobiGlobal, making deposits in @AaveAave.

12 hours later, he redeposited 100M USDC to Huobi. pic.twitter.com/qA3GkCWa3E

— Arkham (@ArkhamIntel) March 10, 2023

According to the data analytics and intelligence organization, the seasoned crypto trader has been moving about some stablecoins over the course of the past few of hours, during which time large amounts have been taken from the Huobi Exchange.

During the course of the previous day and a half, Justin Sun has been seen moving about various stablecoin positions. At first, he withdrew $60 million in USDT, USDC, and USDD from @HuobiGlobal and used those coins to make deposits in @AaveAave. After waiting another 12 hours, he redeposited 100 million USDC to Huobi, as the update states.

It is uncertain whether Sun’s withdrawals and deposits were fast during the crash of HT; yet, the transactions illustrate that significant fund movement can throw off the equilibrium of a normally reasonably stable platform.