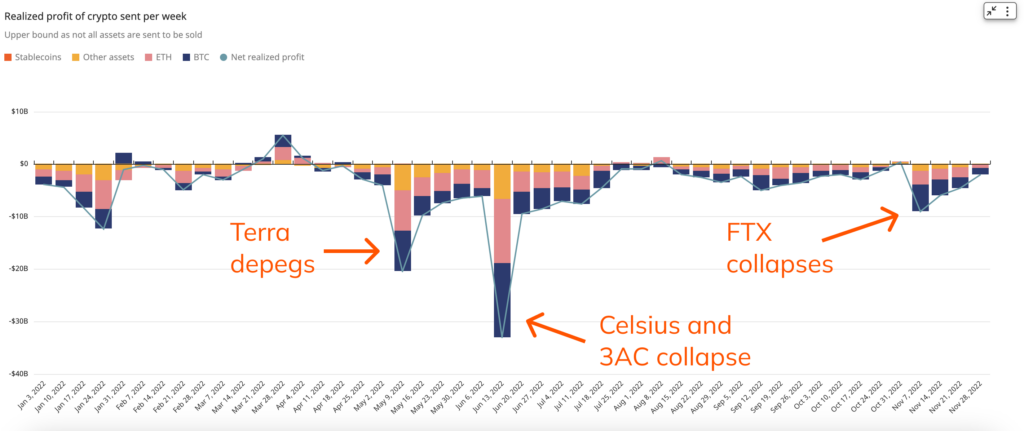

According to research published (1) by Chainalysis, the failure of FTX led to realized losses for cryptocurrency investors totaling around $9 billion.

Chainalysis observed that this loss was insignificant compared to the loss caused by Terra’s UST depeg, which was $20.5 billion. Realized losses were $33 billion due to the collapse of cryptocurrency companies like Celsius and Three Arrows Capitals.

According to Chainalysis, the value of the assets that were in a wallet at the time that they were procured is subtracted from the value of the chunk of the assets that were transferred out of the wallet at the time that the data was recorded. This allows for the calculation of the weekly achieved loss and gain.

Even though the movement of funds out of a wallet does not necessarily indicate a sale, it does provide some insight into how the events in question impacted investors. According to the data, many investors had already lost a considerable amount of money before the crash of the FTX.

Read other stories:

Here is How SBF Spent His First Night in Prison

Binance Looses $3.5 Billion PoR in last 24 hours!

The numbers, however, do not take into account those individuals who suffered a loss of their deposits on the FTX market.

Following the collapse of FTX, realized Bitcoin (BTC) losses reached an annual high of $4.3 billion, which was the highest amount since the beginning of the year.

According to the reports, the failure of FTX had an impact on over one million debtors, and at least $8 billion in money have been reported as missing. Sam Bankman-Fried, the founder of FTX exchange, was taken into custody in the Bahamas and later faced criminal charges in the United States.