On March 7, Argo Blockchain reported its amazing monthly performance in its operations update for February 2023, published on March 7.

In addition to its strong Bitcoin production during the previous month, Argo Blockchain also observed (1) an increase in its revenue during the same period.

Notwithstanding the challenges presented by the network, the Argo Blockchain continues to produce a significant amount of bitcoin.

The press statement states that the cryptocurrency mining company mined 5.7 BTC daily, equivalent to 162 Bitcoin or Bitcoin Equivalents in February.

The amount of Bitcoin that Argo mined in February was a 7% rise over the record that it set in January when it mined 5.4 BTC per day. Even if the company’s degree of productivity increased, the network’s difficulty also increased.

Although the average network difficulty was 10% higher in February than in January 2023, Argo was still able to complete the month with increased Bitcoin production.

As of February 28, 2023, Argo Blockchain has 101 Bitcoin or Bitcoin Equivalents in its possession, following a month of exceptional Bitcoin creation by the corporation. In addition to this, it disclosed that its overall hashrate capacity is still 2.5 EH/s.

The cryptocurrency miner achieved a higher level of revenue than in the previous month’s record. In February, mining revenue was estimated to be $3.74 million [£3.09 million], according to daily exchange rates and prices of cryptocurrencies.

In the meantime, the revenue for January 2023 was $3.42 million [£2.80 million].

Argo Blockchain’s CEO, Seif El-Bakly, praised the team for their outstanding performance in Bitcoin generation and income from February 2 to the 23rd. In the press release, he penned the following:

“Despite the fact that the average difficulty of the network was higher in February than it was in January, I am really pleased of the team for raising our average daily Bitcoin production. This is a direct result of the tireless efforts that our technical and operational teams have put forth. We are continuing to put our attention and resources into improving our internal business processes and working toward achieving operational excellence.”

The Legal Battle Over Argo

In January, Argo’s miners’ investors initiated a class action lawsuit.

In their court petition, the investors alleged that the firm had misled them by failing to provide detailed disclosures on issues that could influence the company’s ability to carry out its operations.

The investors pointed out that Argo Blockchain did not provide sufficient transparency regarding the detrimental effects of network difficulties, high electricity prices, and funding limitations.

This is what the filing says:

“The Offering Papers were negligently drafted, and as a result, they contained inaccurate assertions of a material fact or failed to state other facts necessary to ensure that the statements made did not mislead anyone.”

If investors had known “the truth,” the allegations state that they “wouldn’t have” bought or otherwise obtained said securities, or wouldn’t have bought or otherwise obtained them at the high prices that were paid.”

Argo-Blockchain is a dual-listed corporation, meaning it has listings in both the US and London.

The miner submitted an initial public offering (IPO) application with the United States SEC in September 2021, in addition to trading on the London Stock Exchange.

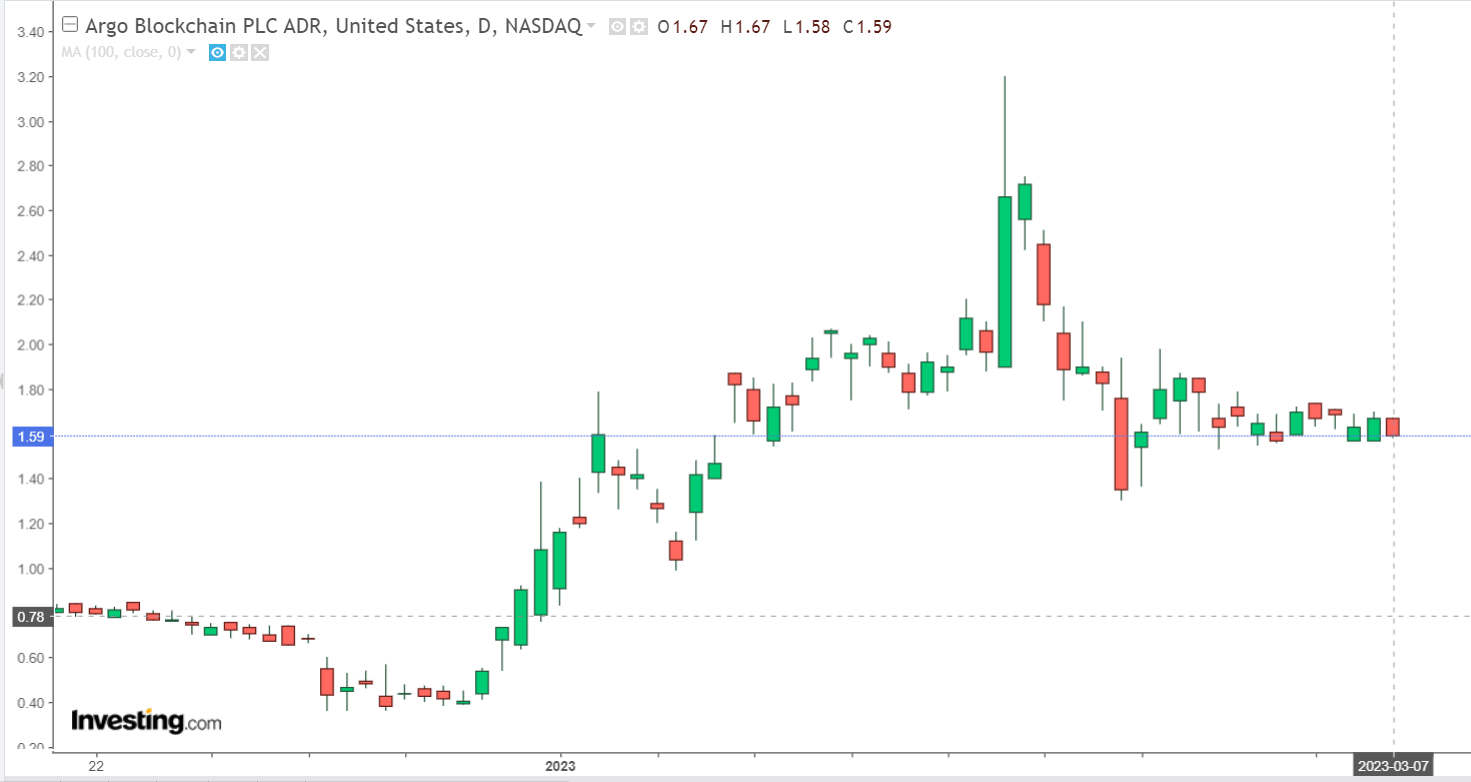

Argo Blockchain was seen trading at $ 1.59, down 3.8 % from its close price on the previous day.