After the regulatory crackdown carried out by U.S. authorities, Binance Dollar (BUSD) experienced a precipitous drop in the number of active addresses. The Binance ecosystem has seen a string of declines in recent weeks, and this latest one is the latest in that trend.

Regression Clearly Visible at the BUSD Active Address

The total active BUSD addresses have decreased to levels that have not been seen since October 23, 2022, according (1) to statistics provided by Glassnode.

These levels have not been seen since the seven-day hourly moving average was calculated over the past seven days.

📉 $BUSD Number of Active Addresses (7d MA) just reached a 5-month low of 94.857

Previous 5-month low of 94.964 was observed on 23 October 2022

View metric:https://t.co/wUemFQQkqN pic.twitter.com/AyUxy5qt6o

— glassnode alerts (@glassnodealerts) March 2, 2023

At the moment, BUSD has an average of 94 active addresses per hour, which is a significant decrease from the end of 2022, when it had an average of more than 250 active addresses hourly. This constitutes a substantial decline for the token, representing a sixty percent fall.

In the meantime, trading volume on the two most widely used stablecoins, USDT and USDC, has experienced a more moderate decline.

Both USDT and USDC have dropped to their respective lows of 5,242 and 2,291. The gloomy feelings that have been sweeping through the Binance ecosystem can be inferred from the declining active address for BUSD.

Binance Dollar Could Be Sued by Regulatory Agencies

In recent weeks, the Binance ecosphere has been shaken to its foundations. Paxos was given the order to halt issuing BUSD by the SEC of the United States in February.

It was also stated that the SEC intends to file a massive lawsuit against Paxos for breaking investor protection regulations, with the regulator stating that BUSD is an unregistered security. The complaint will be filed against Paxos for violating these laws.

Due to the fact that Paxos is a significant issuer of BUSD in cooperation with the Binance exchange, this event generated tremors throughout the cryptocurrency sector.

Following suit, the cryptocurrency exchange Coinbase, which is based in the United States, said on February 27 that it would discontinue trading BUSD beginning on March 13.

The exchange claims that the asset no longer satisfies its current requirements.

The users’ cash will still be accessible for withdrawal at any time, despite the fact that they can no longer trade the stablecoin.

Changpeng Zhao, the CEO of Binance, predicted that the volume of BUSD trades would drop significantly in light of the current circumstances.

On February 17, he stated that the capital was beginning to depart BUSD, and most of it was transferred to USDT, and he was not wrong about either of those statements.

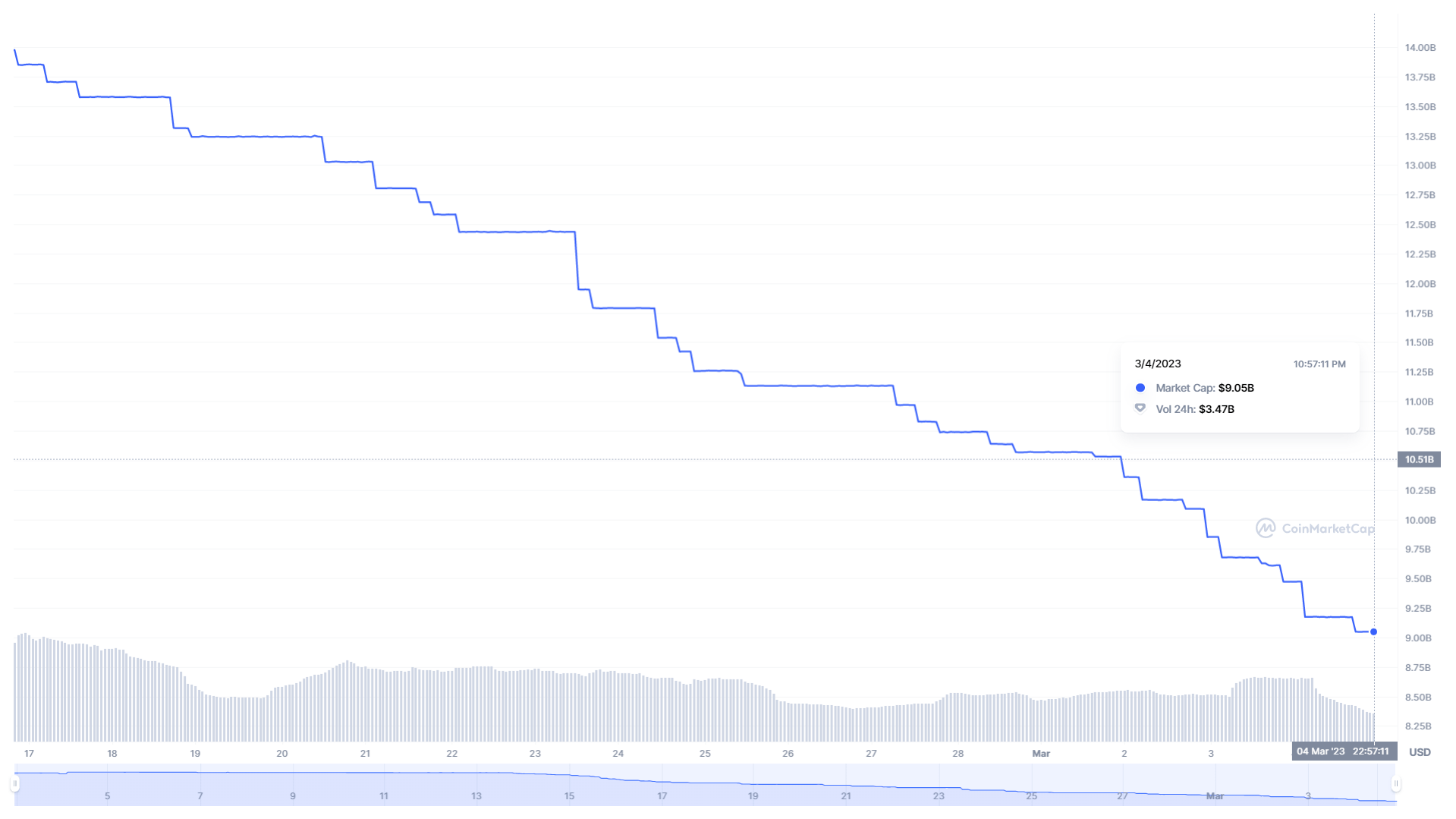

According to data provided by CoinMarketCap (2), ever since it was disclosed that a stop order had been issued for BUSD, its market valuation has decreased by 40%, dropping from $16 billion to $9 billion.

The bearish trajectory of BUSD has been contributed to by these bad happenings, with the coin ranking among the top most dumped coins. In the meantime, it seems that Tether (USDT) has benefited from the regulatory issues that BUSD is currently facing.

Recently, investors have been changing their BUSD to USDT, which has led to a growth in its market cap volume of over 3%.

This trend was also indicated by the data analysis company Santiment, which found that the number of people holding USDT for long periods of time has increased by 16% since the start of the year.

BUSD’s Problems are Crypto Markets Problems

The problems with BUSD have spread to the cryptocurrency market, which is why multiple coins are currently in the red. The most popular cryptocurrency, Bitcoin, has experienced a weekly loss of 4%, and market watchers anticipate that the bearish trend will likely persist for the next few weeks at least.