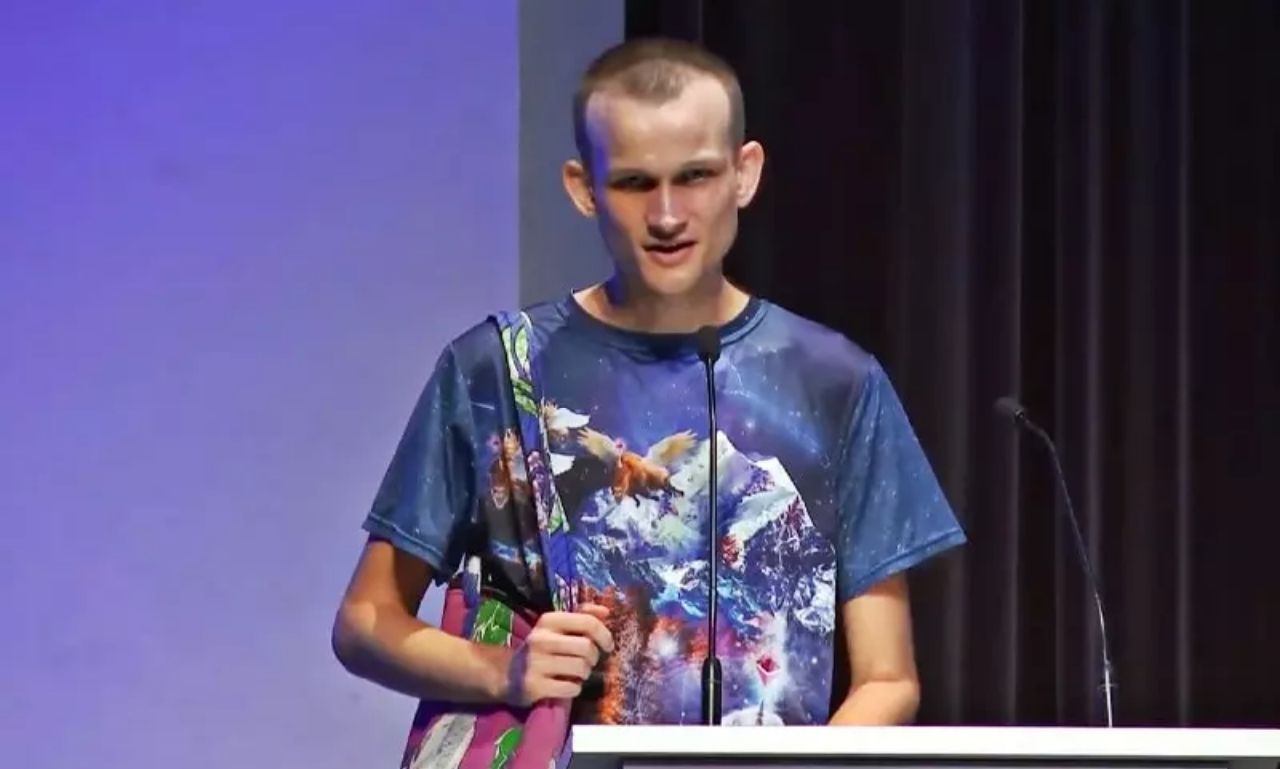

Vitalik Buterin, one of Ethereum’s co-founders, has dropped hints that the much-anticipated integration ‘The Merge’ could take place around the 15th of September.

The merge, which refers to the shift from a proof-of-work (PoW) consensus method to a proof-of-stake (PoS) consensus mechanism, is widely considered to be the most significant software upgrade in the Ethereum ecosystem. Despite this, it has been difficult to track down since it was introduced in December 2020.

Even though Buterin has revealed this information, ETH developers are expected to come up with a definitive date the following week. This is because the final test, known as Goerli, was finalized earlier this week.

A recent call with the developers had indicated that the 19th of September would be the most likely date for the integration.

As soon as the merging is completed, the Proof-of-Stake (PoS) method will make it possible to confirm blocks in a manner that is both more cost-effective and less harmful to the environment. This is because validators would stake ether rather than solve a cryptographic puzzle.

In the meantime, the American global financial bank Citigroup or Citi recently revealed that Ethereum would become a deflationary asset if it transitioned to a PoS consensus mechanism.

Because of this, the cryptocurrency with the second-largest market cap would transform into a “yield-bearing asset.”

Citi also pointed out that the merger will reduce the global issuance of ether by 4.2% annually, which would make the cryptocurrency deflationary.

Therefore, moving to a consensus mechanism based on proof-of-stake would be beneficial to Ethereum’s effort to become a decentralized value storage solution.

According to Citi, because ETH is a “yield-bearing asset,” it will consequently witness an increase in cash flows. As a direct consequence, more appraisal systems have emerged that were not previously accessible.

On the other hand, Buterin just admitted that MakerDAO’s notion of de-pegging its native token DAI from the stablecoin USD Coin (USDC) was a hazardous and awful concept.

Because MakerDAO aims to replace USDC as security with Ethereum, this decision may have been arrived at as a result of tornado sanctions.