The dominance of Binance over Coinbase and other exchanges is reaffirmed. Along with continuing to expand, it is currently the exchange with the largest holding of Bitcoins worldwide.

As the bear market began, Binance and Coinbase’s fortunes stood in sharp contrast to one another. Through a show of force and ongoing hiring, Binance and its CEO Changpeng Zhao earned headlines in the cryptocurrency press. On the other hand, Coinbase as well as its CEO Brian Armstrong voiced several issues. These included rounds of layoffs, delays in hiring, and even speculations of potential insolvency.

Binance Now the Undisputed Leader

Binance is still plotting its future and solidifying its position as the dominant force in the cryptocurrency market, with unending influence. Its BNB token is ranked fifth in market capitalization, and its stablecoin is sixth.

Binance continues to take actions that demonstrate greater cost reductions than fee payments, whereas most businesses suspend and cap user payments.

Indeed, Binance recently disclosed that it had over 2,000 open positions, with the present bear market exacerbating the company’s drive for development and expansion. While several businesses or exchange platforms discontinued specific business relationships simultaneously, Binance increased the number of collaborations.

This was accomplished through collaboration with Portuguese sports star Cristiano Ronaldo. With more than 400 million followers, Ronaldo’s Instagram account is the most popular on the entire globe.

Finally, the exchange has chosen to eliminate transaction costs on Bitcoin as a first step toward celebrating its fifth anniversary and to keep this adjustment going forward.

Read More Stories: Netherlands Fines Binance $3.3 Million for Offering Unlicensed Crypto Services

Coinbases Troubles Not getting Over

The North American exchange is still receiving unfavorable headlines in the meantime. Even more recently, suspicions reappeared after Coinbase discontinued its affiliate program. The NFT marketplace’s demise and the subsequent decline in the value of Coinbase’s stock on the stock market marked the continuation of the failures.

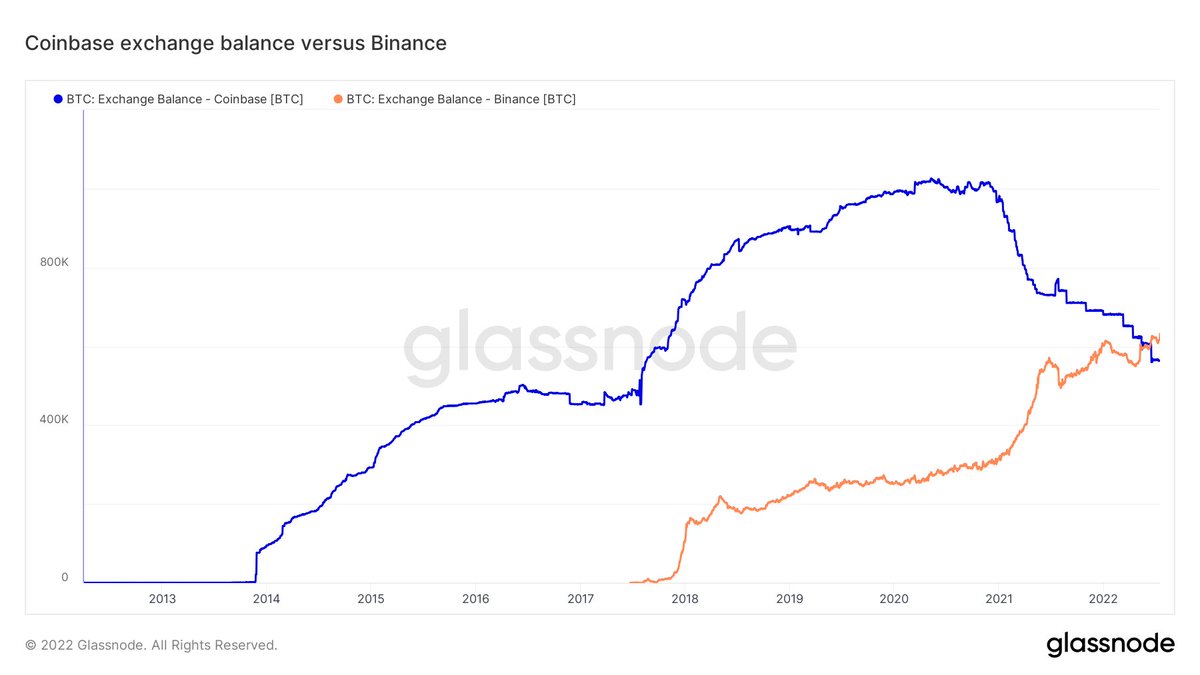

Since 2014, the Coinbase exchange has held the most Bitcoins, but since 2021, the situation has been entirely turned around. In the past, BTC was made by Coinbase and Binance, the latter of which is five years younger. However, since 2021, Binance has seen a dramatic increase in its bitcoin holdings, while Coinbase has had the opposite trend. On July 18, the crossing finally happened.

JUST IN: #Binance has flipped Coinbase to become the #1 exchange in the world with the most #Bitcoin held.

— Watcher.Guru (@WatcherGuru) July 18, 2022

The changeover that started in 2021, when inflows to Binance were quite high, is depicted in the graph below, which comes from Glassnode’s analysis.

Now that the power shift appears to have taken place, it is challenging to imagine how Coinbase might reclaim “its throne” in the face of Binance’s continued expansion. Coinbase might even be surpassed in the future by other exchanges like FTX, which is expanding during the present bad market.

Read more stories: Australian Central Bank Governor: Privatizing the Cryptocurrency Industry is Preferable