Customers of Coinbase Global Inc. have been advised that the company would discontinue its support for the real-time payment network known as Signet, which is operated by Signature Bank.

According to a report (1) by the Wall Street Journal (WSJ), Coinbase notified its customers that the payment network of the defunct Signature Bank would no longer be accessible for on- and off-ramping services.

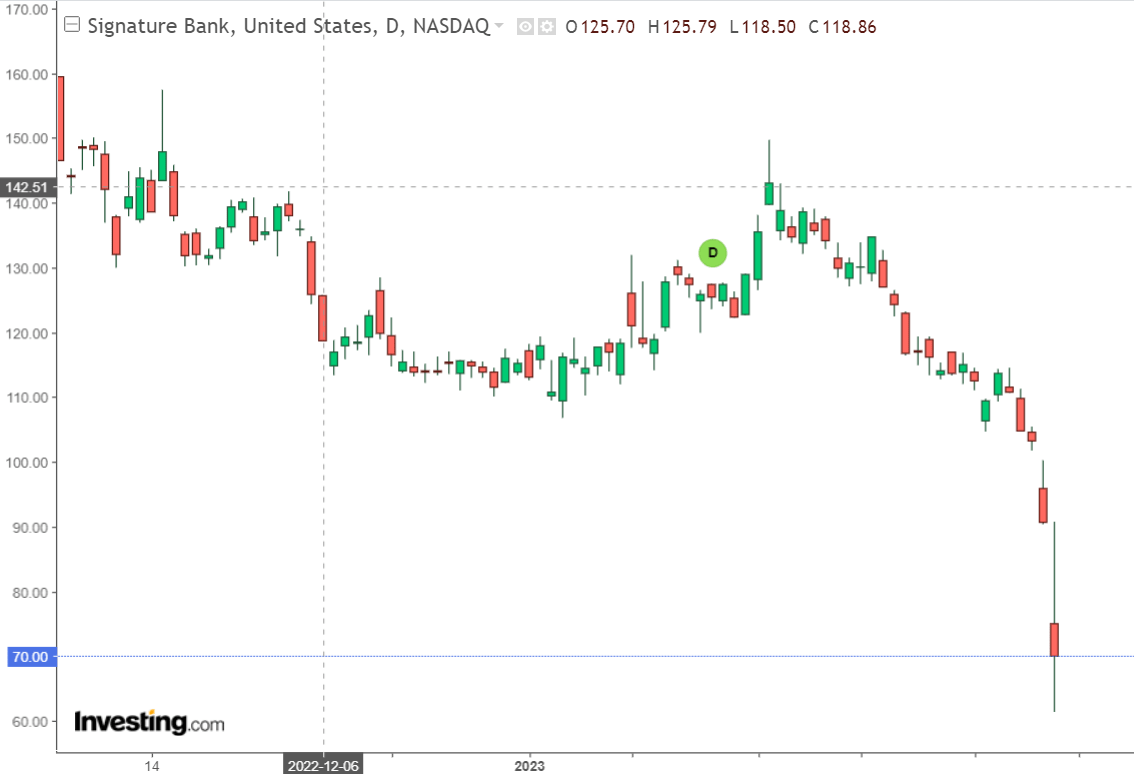

As a direct result of the news, the price of Signature Bank’s stock dropped by about 22.87 percent before reaching $70 at the day’s end of the trade.

Following the completion of an acquisition, the Federal Deposit Insurance Corporation (FDIC) reported on Monday that Signature Bank would become a subsidiary of Flagstar Bank, which is owned and operated by New York Community Bancorp.

Significantly, on March 12, 2023, the FDIC established Signature Bridge Bank with the intention of assuming control of the operations of Signature Bank.

This came about as a result of the New York State Department of Financial Services’ decision to shutter the bank and appoint the FDIC as the receiver.

As of December 31, 2022, the FDIC reported that the previous Signature Bank had total assets of $110.4 billion and total deposits of 88.6 billion as of that day.

Today, we entered into an agreement with a subsidiary of New York Community Bancorp, Inc., to purchase and assume deposits and assets out of Signature Bridge Bank. Read more ➡️ https://t.co/bSshY93lBh. pic.twitter.com/b9RBvYtGF7

— FDIC (@FDICgov) March 19, 2023

In spite of this, Coinbase Global has made the decision to proceed without the assistance of Signature Bank’s payment services in an effort to shield its consumers from any future financial disruptions. As a result of this, Coinbase recommended its users make use of other available payment rails while the company works on onboarding new banking partners.

In addition, a spokeswoman for Coinbase stated to the WSJ that clients will still be able to make deposits and withdrawals of cryptocurrencies as well as smooth transfers from stablecoin USDC to US dollars.

The spokesperson noted that this demonstrates the necessity for an upgraded financial system, despite the fact that the situation is not ideal.

Significantly, Coinbase Global disclosed a 240 million dollar exposure to the defunct Signature Bank, but the company anticipated making a full comeback after the FDIC took over.

The Future of Coinbase Across the World and in the Banking Sector

Since the demise of FTX and the ongoing financial crisis, Coinbase Global has seen an increase in the number of customers it serves from both retail and institutional sectors.

Because of its extensive liquidity, Coinbase Global has garnered the attention of investors despite its status as the largest controlled exchange and a publicly traded firm.

Also, the United States government has, in the past, made deposits in Bitcoin, which demonstrates the high amount of liquidity that is present on the exchange.

The failure of Credit Suisse and First Republic Bank has made the global financial crisis significantly worse (NYSE: FRC). Importantly, during trading on Monday, shares of First Republic Bank fell by more than 47 percent, ultimately reaching a closing price of $12.18.

This is not a cryptocurrency. It’s First Republic, the 14th largest U.S. bank. pic.twitter.com/vMLH6vnujD

— Fintwit (@fintwit_news) March 20, 2023

On the other side, Bitcoin (BTC) and a number of the prominent alternative cryptocurrencies have seen price increases during the previous few days.

Our most recent data on the crypto market indicates that the price of Bitcoin has increased by more than 16 percent in the past week, and it is currently trading at around $28,000.

On the other hand, the price of Ethereum (ETH) has increased by more than 4 percent, and it is currently trading around $1,800.

Featured Image Source: 2.1