According to the findings that Goldman Sachs has made public, Bitcoin’s absolute returns from the beginning of the year till now have seen gains of up to 51%.

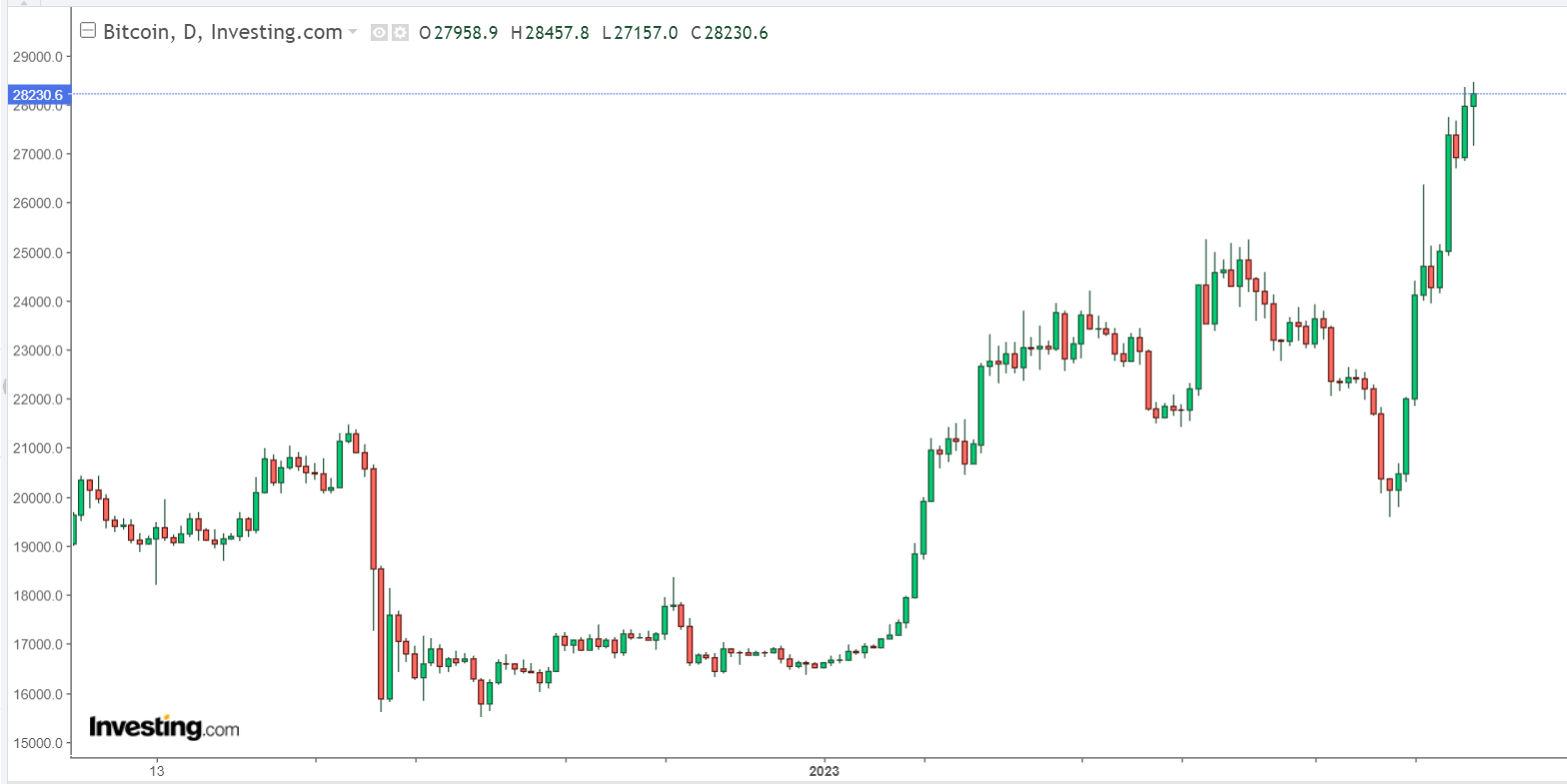

Many people believe that despite the fact that Bitcoin (BTC) has reached highs it hasn’t seen in a long time, there is still a lot of room for growth and that it will eventually attain its maximum potential price. Bitcoin reached a price of $27,000 for the very first time since June of last year on Friday.

The value of the currency rose to $28,457, representing a gain of 1% in the preceding twenty-four-hour period. As of writing this article, the price of one Bitcoin was $28,230, and its market cap reached as high as 546,425,699,021.

At this point in the year, it is up 65.81%. Because of this surge, the Goldman Sachs Group, which is the most successful investment financial services company in the world, has placed (1) Bitcoin at the top of their list of assets that have performed the best this year.

According to the findings that Goldman Sachs has made public, Bitcoin’s absolute returns from the beginning of the year till now have seen gains of up to 51%.

It exceeded the discretionary spending of consumers by 11%, outpaced the Russell 1000 Growth index by 10%, and left behind the S&P 500 by 4%, information technology by 16%, and communication services by 15%.

In addition, Bitcoin has a risk-adjusted return (Sharpe ratio) of 1.9, which places it ahead of its cryptocurrency pairings as well as the big financial institutions that participate in the marketplace.

Bitcoin’s most recent price increase has brought about a shift in the price range that analysts anticipate it will reach. For instance, the Chief Executive Officer of Capriole, Charles Edwards, has the opinion that Bitcoin is currently experiencing a “bump and run reversal,” which indicates that the cryptocurrency has the potential to reach $100,000.

The Chief Executive Officer of Messari, Ryan Selkis, believes that there is a possibility that Bitcoin may reach its price target of $100,000 within the next year.

Bitcoin may reach a price range of $50,000 to $100,000 within the next two to three years, according to Anthony Scaramucci, the owner of SkyBridge Capital, who predicted that the year 2023 will be a “recovery year” for the cryptocurrency.

In the meantime, there are many who are skeptical about the recent spike in the price of bitcoin. For instance, Matthew Sigel, the head of digital assets research at VanEck, anticipates that the price of bitcoin will fall to around $12,000.

He bases this prediction on the fact that rising energy prices are expected. Furthermore, the international financial institution Standard Chartered forecasted that the price of bitcoin will drop to $5,000 in 2023.

What’s Pumping the Bitcoin Market?

A number of notable failures in 2022, including those of projects and hedge funds, as well as bankruptcies, liquidity concerns, and the failure of the FTX exchange, contributed to Bitcoin’s price decline of 65%. Despite this, Bitcoin’s price has already increased by more than half this year.

Market mood, regulatory actions, and rapid adoption are all potential factors that could affect the price of bitcoin.

There are a number of other occurrences that could impact the price of bitcoin, such as political developments, general economic patterns, and the success of competing cryptocurrencies. Investors’ confidence in the currency’s prospects in the future is the primary factor behind its recent appreciation.

A crisis has developed in the banking system of the United States. Since the beginning of 2023, the market capitalization of the six largest US banks—JPMorgan Chase, Wells Fargo, Citigroup, Bank of America, Morgan Stanley, and Goldman Sachs—has decreased by approximately $100 billion. And in this scenario, Bitcoin is an asset that gives higher prospects than banks do of amassing large wealth.