Robert Kiyosaki has issued a warning that a third U.S. bank will fail, while Peter Schiff has stated that a “greater collapse” is on the horizon.

As a result of the failure of Silicon Valley Bank (SBV) & Silvergate Bank within forty-eight hours, the financial system in the United States has been jolted, and economic instability continues.

As a result, participants in the financial sector anticipate that the situation will most certainly get even direr in the days ahead.

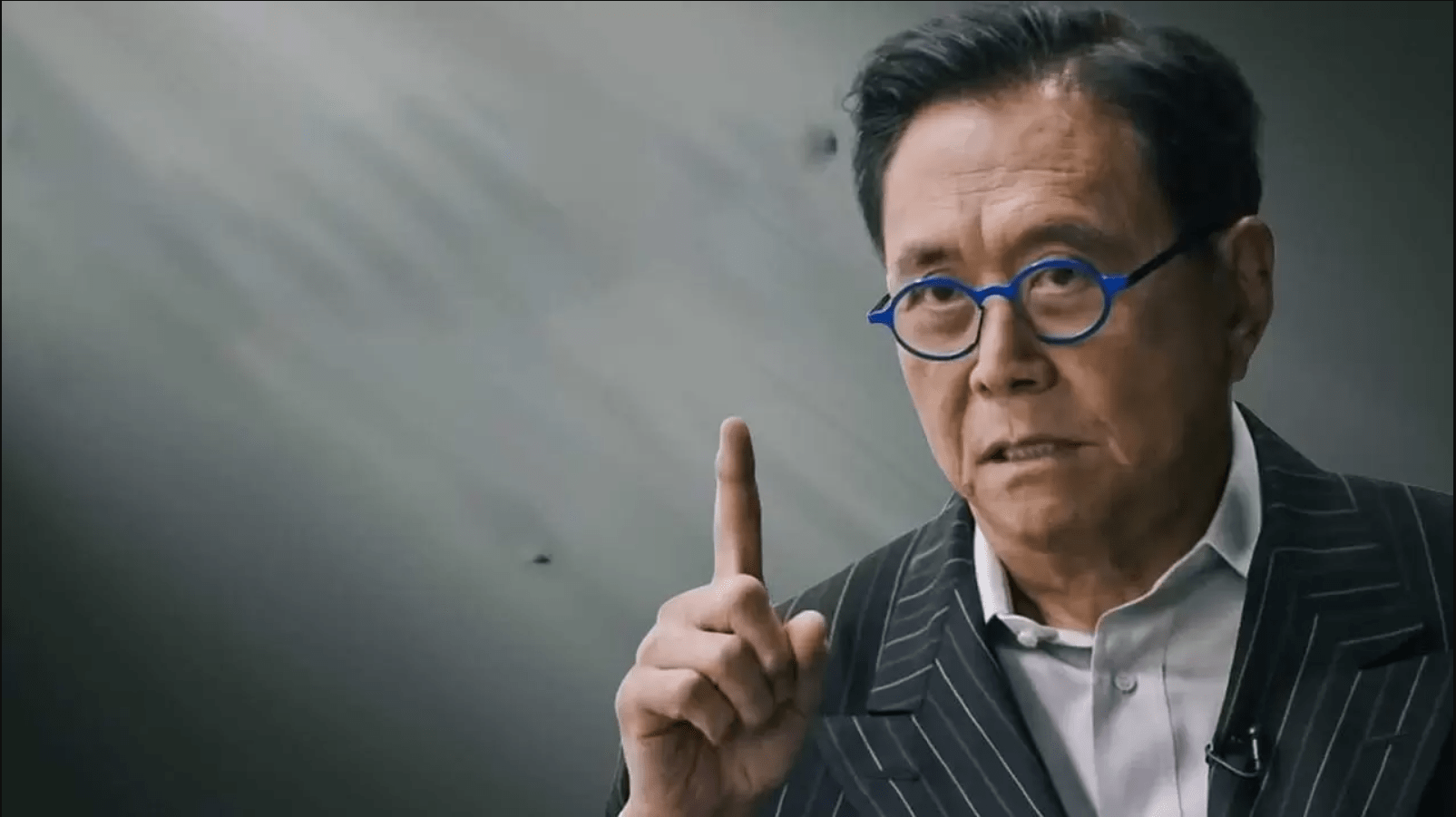

In particular, Robert Kiyosaki, the writer of the financial knowledge book “Rich Dad Poor Dad,” which has sold millions of copies, has warned that a third lender is likely to follow suit.

In a tweet (1) sent out on March 10, he emphasized that the current circumstances will benefit precious metals.

Kiyosaki’s projection coincides with an earlier prediction that the Lehman Brothers would go bankrupt in 2008.

Importantly, the collapse exacerbated the financial crisis that began in 2008, and the event was regarded as a defining landmark.

“Two of the World’s Largest Banks Have Failed. #3 set to go. PURCHASE REAL COINS OF GOLD AND SILVER RIGHT NOW. No ETFs. When Bank #3 fails, the price of gold and silver will skyrocket. 2008 I predicted Lehman Brothers’ failure days before it occurred on CNN.

He told them, “If you want proof, go to RICH DAD dot com.”

This warning from Kiyosaki about a third bank failing comes at a time when rumors concerning the future of another investment bank that is favorable toward cryptocurrencies, Credit Suisse, continue to accumulate.

This comes as a result of the bank’s announcement that it would be delaying the annual report following a call with the SEC about the lender’s statements of cash flows for 2019 and 2020.

Kiyosaki has predicted a wider economic collapse across the globe while emphasizing that bank runs could become more common due to the crisis.

Peter Schiff, an economist, and crypto-skeptic, has warned (2) that the United States banking system is on the cusp of having a “far larger collapse” compared to the financial crisis that occurred in 2008. This statement comes as uncertainty continues to dominate.

On March 10, Schiff issued a warning, stating that widespread withdrawals would result in failures.

“The U.S. banking system is on the verge of collapsing considerably more severely than in 2008.”

The interest rates on the long-term paper held by banks are historically very low. They are unable to compete with short-term Treasury bonds in the market.

He predicted that the widespread cash withdrawals from depositors looking for greater returns would cause a tidal wave of bank bankruptcies.

The US banking sector is experiencing a crisis

The failure of Silvergate Bank, a lender whose primary focus was on collaborating with cryptocurrency firms, sparked the fears circulating in the financial sector.

As a direct consequence, the cryptocurrency market has completely melted down, resulting in a major drain of capital from the industry.

During the same period, the price of Bitcoin (BTC) dropped to levels last seen during the bear market of the previous year.

On the contrary side, Silicon Valley Bank, the sixteenth-largest lender in the United States, was forced to close its doors and was taken over by the relevant authorities.

Also, the bank had business dealings with crypto corporations and Silicon Valley companies, particularly technological start-ups.

Disclosing that a portion of its reserves was kept at SBV, Circle, the company responsible for issuing the USDC stablecoin, caused the closure to spread to the cryptocurrency market. At the time of this publication, the USDC had de-pegged from the dollar and was trading at $0.91.