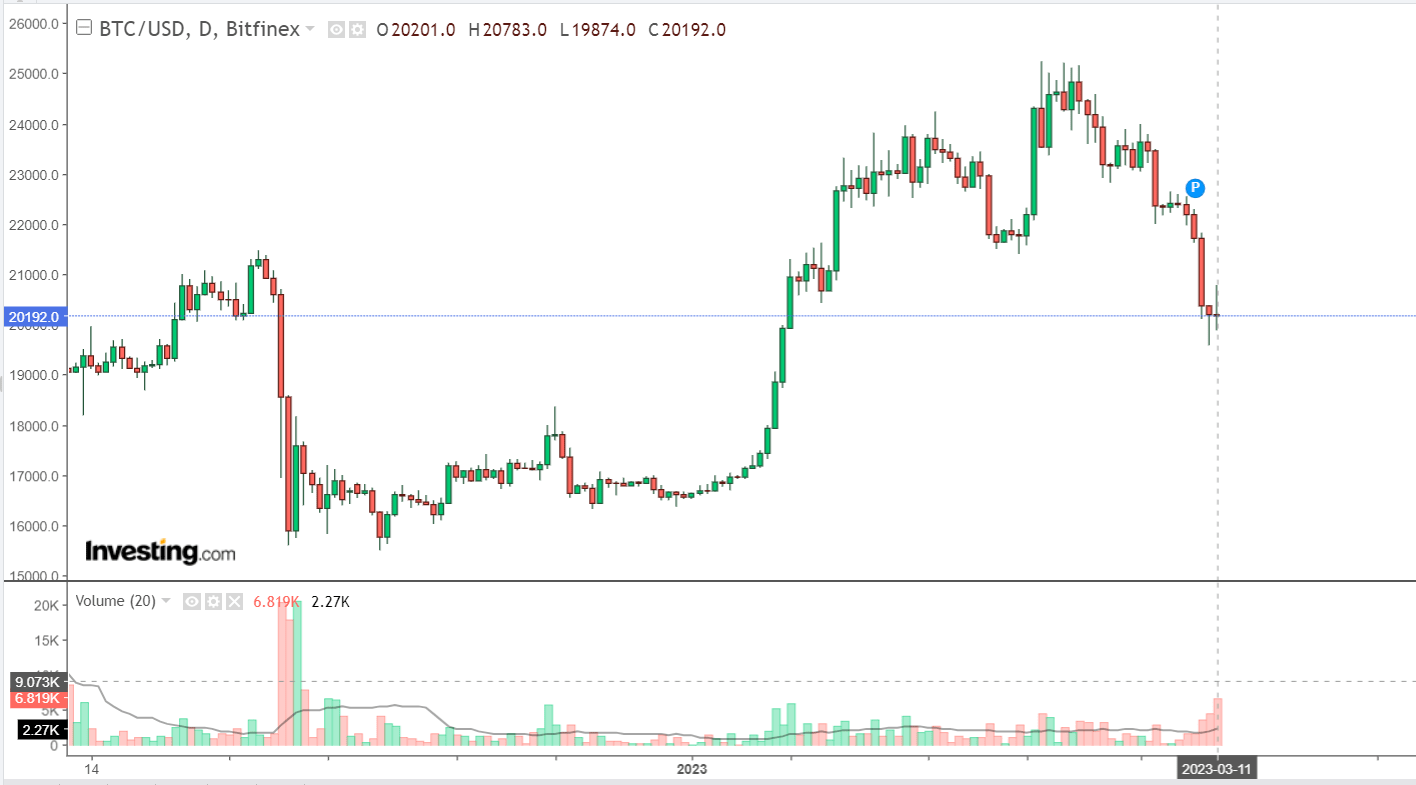

The worst sell-off of the year occurred on March 10, when the cryptocurrency market unexpectedly went red. The bitcoin price fell below $20,000 for the first time in three months, and the gloomy sentiment is prevalent in the market.

Leveraged traders have been left reeling due to the aftermath of the crash, which saw millions of dollars worth of open trading positions wiped out during this time.

Derivative Traders Suffer Massive Losses

According to data (1) provided by CoinGlass, derivative investors have suffered a loss of around $202 million over the last twenty-four hours. When traders anticipate using derivatives or borrowing from the exchange, they participate in leverage trading or the futures market.

Traders participating in this kind of market have the option of either “going long” or “going short”. When the price hits a specific level inconsistent with the trader’s position, the trade is terminated, and the client suffers a capital loss.

Further analysis of the data provided by CoinGlass reveals that Bitcoin has the highest liquidation volumes, coming in at over $60 million, with Ethereum coming in at a distant second with $52 million.

This should not be a surprise, given that they are the two coins that see the most volume on the cryptocurrency market.

Since the middle of January, this is the biggest number of liquidations that have been reported. On that particular occasion, the market’s bearish trend resulted in the liquidation of more than $490 million in assets across various exchanges in a single day.

The Collapse of the Cryptocurrency Market Caused By Several Reasons

Recent events have contributed to the steep price drop that has been hurting the cryptocurrency market.

The cryptocurrency bank Silvergate announced on March 9, 2023, that it would cease operations and close its doors.

This happened less than a week since Silvergate Capital Corporation had announced that it was considering whether it would continue functioning this year and shuttered its crypto payment network.

This news also came shortly after Silvergate Capital Corporation had closed its crypto payments system.

The announcement that New York AG Letitia James has officially filed a lawsuit against cryptocurrency exchange Kucoin added fuel to the fire of these negative views.

According to the allegations in the lawsuit, Kucoin offered, sold, and purchased securities without properly registering to do so.

Additionally, it asserts that ETH, the native token of the Ethereum blockchain, is a security despite being a cryptocurrency.

According to James, ETH might be considered a security since it represents the investment of money in common companies, and securities typically result in returns that are primarily attributable to the efforts of people other than the investor.

According to the allegations made by the prosecutor, Kucoin, which is one of the oldest exchanges, is involved in the business of selling and offering to sell commodities to New York accounts via accounts, agreements, or contracts. The primary function of these transactions is for investment purposes.

In addition to cryptocurrencies themselves, other external variables, such as recent projections from the US Federal Reserve, have impacted the market.

The Fed Chair, Jerome Powell, recently testified in front of the Senate Banking Committee of the United States that the current economic outlook is not what was anticipated.

The projections for inflation are likely to result in the Federal Reserve raising interest rates above what was originally anticipated during their meeting on March 22.

At the time of this writing, the price of bitcoin has recovered slightly from its recent drop, and it is currently trading at $20,192.