The cryptocurrency venture capital firms’ portfolio companies were encouraged by the firms to withdraw their assets from the United States commercial bank Silicon Valley Bank (SVB).

Specifically, five crypto-focused VC investors have strongly recommended to their portfolio firms that they remove their cash from the banks as a safeguard.

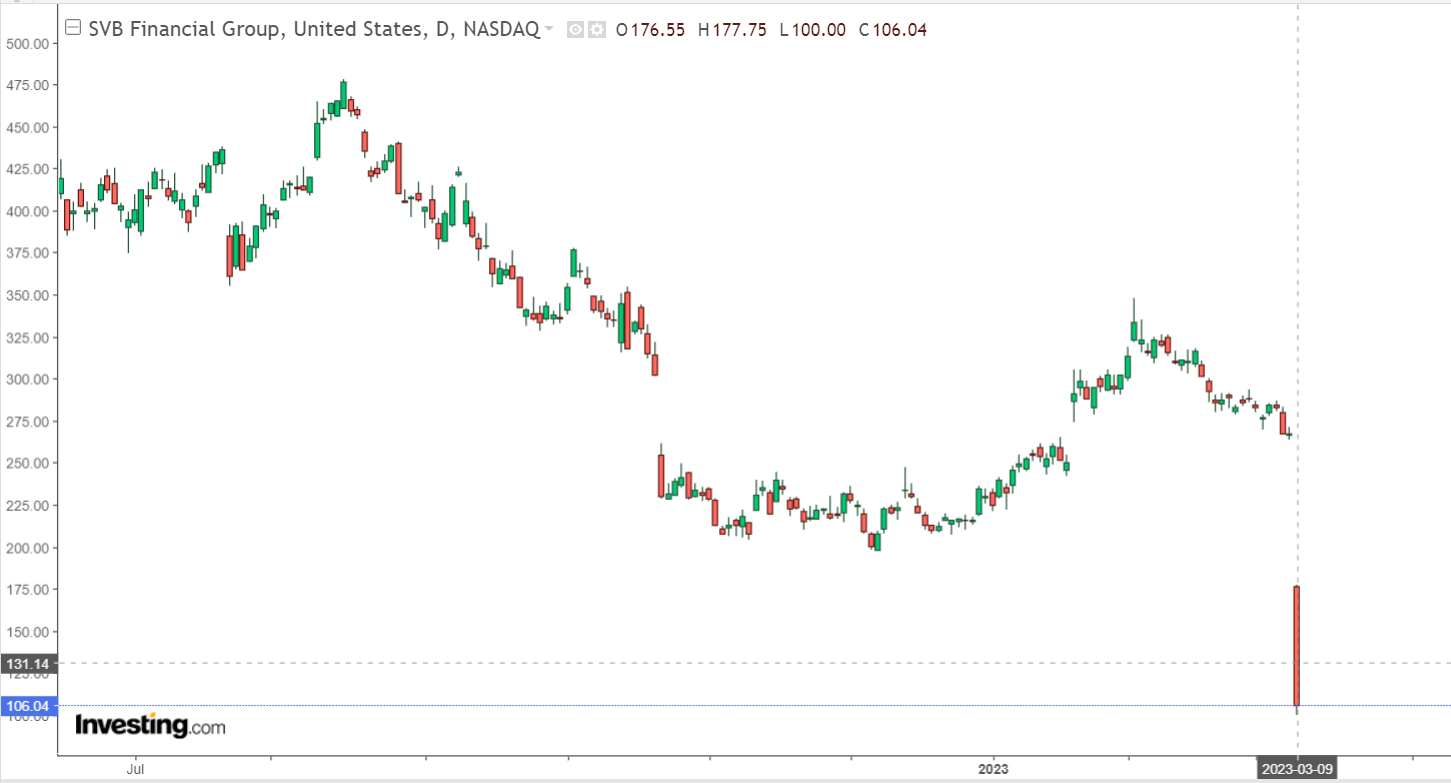

This comes when Silicon Valley Bank Financial Group is having difficulty convincing customers following a capital raise resulting in a significant drop in stock price.

To strengthen its balance sheet, the bank on March 8 announced plans (1) to offer 1.25 billion dollars worth of its ordinary stock.

As per the commercial bank, it would utilize the profits from the sale to fill a hole in its balance sheet caused by the sale of a portfolio with a loss of $1.8 billion valued at $21 billion.

Also, it was disclosed in an investor brochure that the yield on the portfolio was an average of 1.79%, which is lower than the current yield on the 10-year Treasury note, which is approximately 3.9%.

Concern among investors was prompted by a number of unanswered questions concerning capital raising, most notably the possibility that the amount raised may not be adequate given the current market climate for many firms supported by SVB.

Concerns expressed by investors caused the stock of Silicon Valley Bank to fall to its lowest point since 2016.

The loss for the commercial bank was 6.41% at the closing of regular trading, and it increased to 21.82% during after-hours trading. At the time of this article’s publication, SVB trades at $82.90, representing a loss of 62.72% over the past five days.

According to data provided by MarketWatch, the financial firm has not experienced any growth over the course of the past year. More than 80% of its value has been wiped off over the course of the past year, and the company’s year-to-date record shows a decline of 53.92%.

In addition, it has dropped by almost 52% over the course of the previous three months and has dropped by 65.81% during the course of the previous month.

Crypto Focus VCs Pulling Out Funds From SVB

As a result of the problem, Silicon Valley Bank’s Chief Executive Officer Gregory Becker has already been contacting customers to reassure them that their money is safe with the bank.

The same sources who disclosed the communication with customers also mentioned that several businesses have begun suggesting to its founders that they take their money out of the banks as a preventative measure.

One of the individuals familiar with the situation shared the information that Peter Thiel’s Founders Fund has instructed portfolio businesses to discontinue doing commerce with SVB.

A San Francisco-based start-up company has already verified to Reuters that they have moved all of their capital out from SVB as of March 9.

Additionally, the company claimed that the payments had been “waiting” on their second bank account before the end of the business day on which they were received.

Officials from the blockchain VC firm Eden Block and the investment firm Mechanism Capital stated that they had urged businesses to withdraw their associates from Silicon Valley Bank.

At the same time, a representative for Pantera Capital acknowledged that the hedge fund has begun advising portfolio firms to think about opening numerous accounts.