According to the most recent White House report to Congress, the government of former Vice President Joe Biden mentioned that most crypto assets are either uncontrolled securities, a commodity, a derivative, or other investment derivatives, depending on the basics underpinning them.

As a consequence, all digital assets, except for Bitcoin, which is generally considered digital gold, have already been scrambling to get a beneficial categorization from the United States and other jurisdictions.

Which category better describes Ethereum: security or a commodity?

In a conversation (1) that took place on Thursday at the 2023 Paris Blockchain Week, Joseph Lubin, one of the co-founders of Ethereum, stated that Ether is not a security. Arjun Kharpal was the interviewer for CNBC.

Instead, Lubin suggested that Ethereum ought to be regarded as a commodity similar to oil, which is essential to the functioning of the world economy.

In addition, investors purchase oil with the expectation of making a profit even though the commodity is not considered to be a security.

Lubin believes that the digital asset, Ethereum (ETH), now meets the criteria to be categorized as a commodity because it is utilized to power many Web3 products.

At the beginning of this month, the Attorney General of the State of New York, Letitia James, initiated legal action against the cryptocurrency exchange known as KuCoin for not registering as a securities and commodities broker-dealer.

“This case is one of the first instances a regulator is arguing in court that ETH, one of the major cryptocurrencies available, is security. ETH is one of the largest cryptocurrencies available.

“The petition asserts that ETH, just like LUNA and UST, is a speculative investment that depends on the attempts of third-party creators to provide profit to the holders of ETH,” as per New York AG Letitia.

In addition, the SEC has maintained that all digital assets other than Bitcoin are unregistered securities, despite Bitcoin being a decentralized cryptocurrency.

In addition, the chairman of the Securities and Exchange Commission, Gary Gensler, has made it public that he believes all proof-of-stake (PoS) protected blockchains from being unregistered securities.

As a direct consequence, the Securities and Exchange Commission (SEC) has just lately handed Coinbase Global Inc a Wells notice regarding its staking and listing services being unregistered securities.

Coinbase has already signaled that they are looking forward to letting this lay on its merits, even if it is obvious that some major litigation is now making its way through the United States legal system.

Market Outlook

The market for Ethereum has a valuation of approximately $219 billion, and its daily trading volume is relatively close to that of Bitcoin. Coingecko’s analysis of the market indicates that Ethereum had a 24-hour traded volume of about $11 billion, whereas Bitcoin’s figure was $19.9 billion.

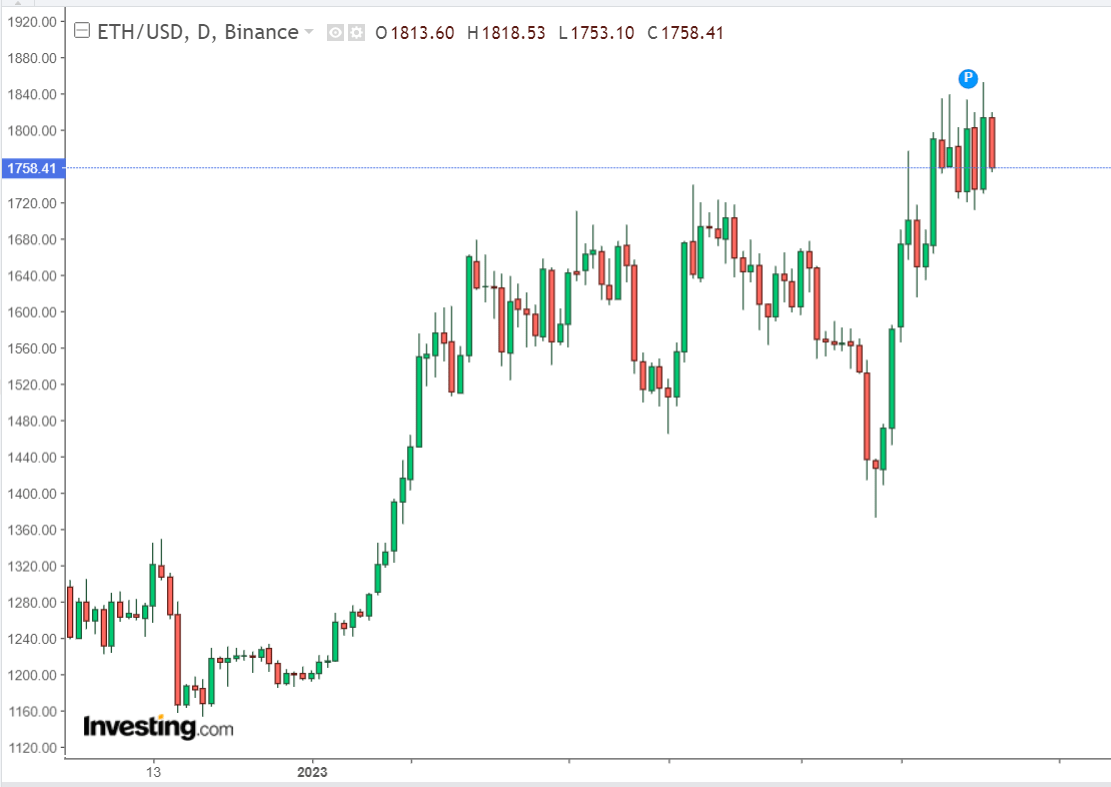

The price of Ethereum, which was trading at about $1,758.41 on Friday, rose nearly 2.8 percent during the course of the previous twenty-four hours.

It has been reported that over $33 million worth of Ether was traded on the futures market over the course of the previous twenty-four hours.

Comments are closed, but trackbacks and pingbacks are open.