As a result of the Federal Reserve and the Federal Deposit Insurance Corporation assuring depositors that they could withdraw their money from Silicon Valley Bank, investors in cryptocurrencies have gained some confidence.

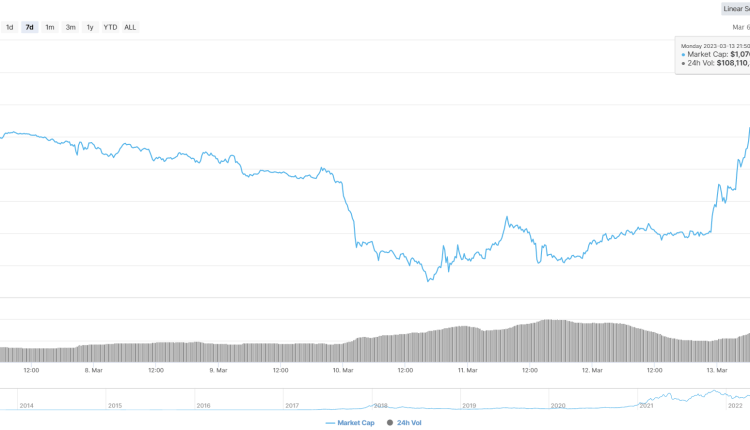

The overall cryptocurrency market staged a resounding return early on Monday, March 13, and surged back above the $1 trillion milestone.

The three US regulators are the Federal Reserve (Fed), the United States Treasury, and the Federal Deposit Insurance Corporation (FDIC).

They intervened in the emerging crisis in the banking sector just as this unexpected rally in the cryptocurrency area began.

The Silvergate Bank decided to close its doors early last week in response to significant problems with liquidity.

The Fed and the FDIC Are Trying to Help SVB Depositors

In the later hours of Friday, March 10, Silicon Valley Bank announced that it would be closing its doors, marking one of the most significant banking failures since the financial meltdown of 2008.

The SVB has its funds invested in United States Treasuries, which have experienced a decline in value due to the Federal Reserve’s decision to raise interest rates.

Some banks have been compelled to sell these Government notes at a loss to strengthen their financial standing. The reason for this is unclear.

Later on Sunday, March 12, regulators in the United States declared that Signature Bank would be shut down to stop any potential contagion.

Investor confidence has increased due to this action taken by the regulators to establish a backstop for SVB and protect the depositors.

Account holders at SVB will have total access to all of the funds they have with the bank, according to a statement made jointly by the three regulatory agencies on Sunday.

The authorities have stated that the taxpayer will not be responsible for any losses incurred as a result of the settlement of Silicon Valley Bank.

Vijay Ayyar, VP of corporate development at cryptocurrency exchange Luno, gave the following statement (1) to CNBC regarding the latest development:

“The markets have become jubilant knowing that depositors’ money is secure and a huge possible bank run has been averted thanks to the Fed’s announcement over the weekend of a backup for banks and notably Silicon Valley Bank,”

Gains for Bitcoin and Other Cryptocurrencies

The cryptocurrency market has reacted positively to the Fed’s corrective efforts by registering a significant rally earlier today.

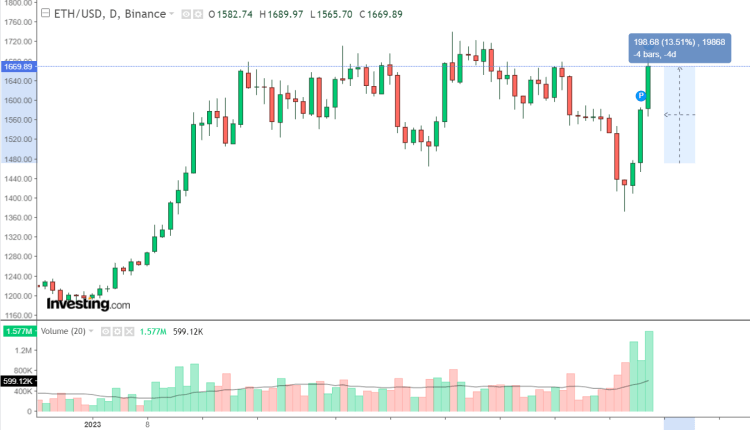

This is a positive sign for the market. In addition to Bitcoin (BTC), alternative cryptocurrencies have performed fairly well, as seen by the price of Ethereum (ETH) shooting up by more than 9 percent and leaping beyond the $1,600 barrier.

Other prominent gainers in this cryptocurrency market recovery include BNB Coin, which rose by more than 11.5% and moved above $300. Cardano (ADA) rose by more than 12% to trade at $0.3436, and Solana (SOL), rose by more than 14% and crossed the $20 threshold.

It will be fascinating to see how Wall Street responds going forward in Monday’s trading session, even though the cryptocurrency market has shown early signs of confidence.

The direction that cryptocurrency prices go from here will be entirely determined by how equities in the US behave.

At this time, the Dow Jones Futures have experienced a decline of 0.62%, trading at $32,232. On the other hand, the futures contract for the S&P 500 is showing gains of 1.66%.

All figures were taken from investing.com.

Comments are closed, but trackbacks and pingbacks are open.