The value of Dogecoin (DOGE) on the cryptocurrency market has dropped as widespread panic and anxiety followed the collapse of Silicon Valley Bank on Friday morning, the second-largest commercial bank collapse in U.S. history.

Market sell-offs have been spurred by the collapse (1) of crypto-friendly bank Silvergate, with the current valuation of top meme tokens dropping by roughly 1.8% in the past 24 hours. The supply of DOGE has increased by about 30% in volume, signaling a severe market correction is imminent.

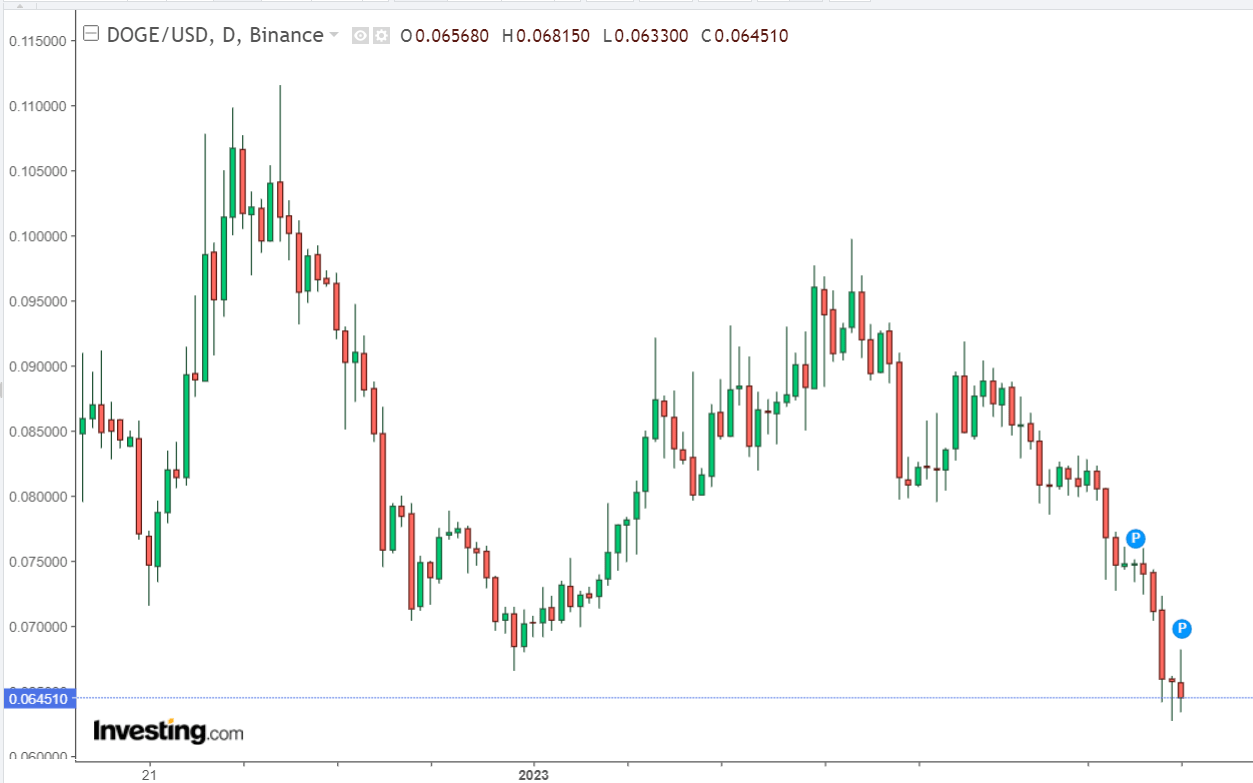

As of this writing, one Dogecoin could be purchased for $0.0645, a 20% drop over the past week. The value of the canine-themed coin has dropped 1.8% in the previous 24 hours, according to data from investing.com.

The price of the meme token has dropped 31% over the past 30 days, 24% over the past two weeks, and only 2% since the start of 2023.

While BTC investors prepare for the next chapter in the protracted catastrophe that has befallen Silicon Valley Bank, the price of Bitcoin, the largest crypto in terms of market cap, has fallen from the $21,000 level, trading at $20,190 at the time of writing.

Due to its high degree of speculation and lack of basic value, DOGE contributes to macroeconomic uncertainty. Because investor and trader demand is the primary factor in determining its price, it is volatile and sensitive to abrupt fluctuations in market mood.

The collapse of a Silicon Valley bank weighs on the DOGE

Yet, the sudden collapse of Silicon Valley Bank is mostly responsible for today’s drop in DOGE price.

Some of SVB’s decrease can be ascribed to the Federal Reserve’s dramatic increase in interest rates over the past year.

Long-term Treasuries were gathered by banks as a low-risk investment option when interest rates were near zero.

Unfortunately, the value of these investments declined when the Fed tightened interest rates to control inflation, resulting in bank capital losses.

Despite this, DOGE’s 24-hour transaction volume has risen to $681 million, an increase of 103%. This indicates brisk market activity, which, under favorable conditions, can easily translate into gains.

Does the implosion of SVB affect the launch of Shibarium?

But, according to Shibburn, the burn rate of the SHIB army’s favorite meme coin has climbed by an astounding 36,497.56%, giving them cause for celebration.

The sudden increase in the crypto’s burn rate may be due to the imminent release of the Shibarium Beta layer-2 blockchain.

The severity of the SVB collapse and its impact on investor confidence and anticipation of the introduction of Shibarium could influence the course of events.

The Bitcoin Market Takes Another Hit?

Meanwhile, following Silicon Valley Bank’s demise and the rise of fear, uncertainty, and doubt (FUD) concerning hidden dangers in the banking and finance sectors, some market experts now foresee further suffering for the crypto sector.

The head of Whalen Global Advisers, Christopher Whalen, was quoted by Reuters as saying:

While “short sellers are out there and they’re going to target every single bank, particularly the smaller ones,” next week “may be a carnage.”

Market activity is robust thanks to SHIB, but whale trades have decreased as larger addresses have begun to liquidate their holdings.

In the meanwhile, experts are watching Silicon Valley Bank closely to see how their news will affect the value of Dogecoin in the following days.

Comments are closed, but trackbacks and pingbacks are open.